Apresentao2Q11ENG

-

Upload

multiplan-ri -

Category

Documents

-

view

216 -

download

0

Transcript of Apresentao2Q11ENG

-

8/6/2019 Apresentao2Q11ENG

1/14

2Q11

2Q11 Earnings Release

-

8/6/2019 Apresentao2Q11ENG

2/14

2Q11

R$309 MR$349 M

2Q10 2Q11

R$47 M

R$67 M

2Q10 2Q11

R$167 M

R$209 M

2Q10 2Q11

R$25 M

R$32 M

2Q10 2Q11

R$1,170 MR$1,408 M

R$1,715 M

R$1,967 M

2Q08 2Q09 2Q10 2Q11

Shopping Center Sales1

21 Considering 100% of shopping center sales.2 April and May compared to the same period in 2010.

Multiplan Shopping Center Sales vs.National Retail and Inflation (2Q11/2Q10)

2Q Total Sales Evolution

+14.7%

+26.4

%

Shopping Santarsula

Shopping Center Sales Highlights (R$)

10 years CAGR: 17.2%

Shopping VilaOlmpia

+42.9%

BarraShopping BH Shopping

+13.2% +25.0%

8.2%

14.7%

NationalRetail Sales

(IBGE)

Total Sales

10.3%9.4%

6.6%

SAS SSS IPCA

2

-

8/6/2019 Apresentao2Q11ENG

3/14

2Q11

94.3 M

108.4 M14.9 M 0.3 M 1.1 M

Rent 2Q10 Base Overage Merchand. Rent 2Q11

3

Rental Revenue Analysis

Rental Revenue Growth Breakdown (2Q11/2Q10)2Q11 Gross Revenue Breakdown (%)

+15.0%

Key money5.9%

Parking11.1%

Real estate

4.9%

Services12.4% Base

86,1%

Overage4.3%Merchandising

9.7%

Straight line eff ect4.0%

RentalRevenue

61.5%

+18.9% -9.5%+7.1%

Rental Revenue Growth Analysis (2Q11/2Q10)

8.8%

+12.9%+14.1%

+15.0%

IGP-DIAdjustment

Effect

Same AreaRent

Same StoreRent

RentalRevenue

-

8/6/2019 Apresentao2Q11ENG

4/14

2Q11

5.5%6.7%

8.6%

10.7% 11.1% 10.0%

7.3%

2.9%

0.2%-0.3%

0.6%

4.0%

7.3%8.8%

2.1%

2.2%

2.8%

2.9% 1.9% 3.6%

0.8%

3.4%

3.7% 4.8%

6.0%

7.7%2.8%

4.9%

7.7%

9.0%

11.6%

13.9%13.2%

14.0%

8.1%

6.5%

3.9%4.4%

6.6%

12.0%

10.3%

14.1%

1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11

IGP-DI adjustment Effect Real SSR growth

4

Same Store Rent Analysis

Same Store Rent Real Growth (YoY)

-

8/6/2019 Apresentao2Q11ENG

5/14

2Q11

106.3 M

127.1 M

86.7%

88.1%

2Q10 2Q11

6.4 M

10.0 M

2Q10 2Q11

5

Shopping Center Expenses and NOI

Shopping Center Expensesand as % of Net Revenue (2Q11/2Q10)

NOI + Key Money and Margin (2Q11/2Q10)

Key Money Accrued (2Q11/2Q10)

NOI and Margin (2Q11/2Q10)

+6.0%

+58.2%

+17.1%

+19.6%

99.9 M

117.0 M

86.0%

87.2%

2Q10 2Q11

16.3 M

17.2 M

12.3% 11.4%

2Q10 2Q11

-

8/6/2019 Apresentao2Q11ENG

6/14

2Q11

89.3 M

112.6 M

67.6%

74.6%

2Q10 2Q11

78.6 M

109.3 M

59.5%

72.4%

2Q10 2Q11

80.9 M

107.1 M

56.6%

67.5%

2Q10 2Q11

EBITDA Analysis

6

Shopping Center Adjusted EBITDA andMargin (2Q11/2Q10)Shopping Center EBITDA andMargin (2Q11/2Q10)

Consolidated EBITDA andMargin (2Q11/2Q10)

+32.4%

G&A Expenses Evolution and as a% of Net Revenue

+39.1%

+26.2%

-20.7%

25.3 M24.7 M

23.0 M

21.6 M

20.1 M17.7%16.9%

12.9%

13.7%

12.6%

2Q10 3Q10 4Q10 1Q11 2Q11

-

8/6/2019 Apresentao2Q11ENG

7/14

2Q11

62.6 M

76.0 M

43.8%

47.9%

2Q10 2Q11

52.2 M

61.1 M

36.5%

38.5%

2Q10 2Q11

Net Income and Net Margin(2Q11/2Q10)

FFO and FFO Margin(2Q11/2Q10)

7

Financial Results

+17.0%

+21.3%

-

8/6/2019 Apresentao2Q11ENG

8/14

2Q11

8

CAPEX and Indebtedness

CAPEX Breakdown (2Q11/2Q10)

Debt Position and Cash Generation (R$)(on June 30th, 2011)

Debt Indexes Breakdown(on June 30th, 2011)

Funding Breakdown(on June 30th, 2011)

brAA+BB+

PositiveOutlook

559.5 M

518.4 M

41.1 M

394.0 M373.9 M

Cash Gross Debt Net Cash

Position

EBITDA LTM AFFO LTM

TR64.0%

IGP-M18.0%

IIPCA11.0%

TJLP5.0%

CDI2.0%

Drawn518.4 M

To beDrawn405.8 M

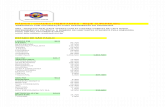

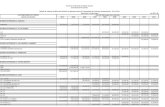

CAPEX (R$) 2Q11 2Q10 1H11 1H10

Mall Development 128.2 M 23.2 M 207.5 M 46.9 M

Mall Expansion 5.5 M 24.2 M 11.3 M 49.0 M

Office Towers for Lease 24.1 M 9.2 M 31.6 M 10.9 M

Renovation & other 8.0 M 22.9 M 19.8 M 35.3 MTotal 165.8 M 79.6 M 270.1 M 142.1 M

-

8/6/2019 Apresentao2Q11ENG

9/14

2Q11

LeasedStores79.2% To be

Leased20.8%

93.3%

85.3%

78.1%

65.9%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11

LeasedStores(units)

ParkShoppingSoCaetano

VillageMall

JundiaShopping

ParkShoppingCampoGrande

9

Key Money and New Projects for Lease Expenses

Projects Signed Key Money and New Projects forLease Expenses in 2Q11 (R$)

Leasing Evolution

Deferred Income Evolution (R$)

Leasing Status(July, 2011)

Number ofStores: 795

21.0 M

3.3 M

Projects Signed Key Money New Projects for LeaseExpenses

81.2M

96.4M110.2M 110.5M

121.5M126.3M

138.8M141.2M

137.1M

132.M136.7M

150.M158.5M

183.7M

189.6M

204.6MDelivery

ofprojects

Newprojectslaunched

-

8/6/2019 Apresentao2Q11ENG

10/14

2Q11

10

New Projects Under Development

Shopping Centers Under Development

1 Multiplan will invest 100% of the CAPEX.

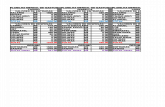

Shopping centers under development Multiplans Interest (R$000)

Project OpeningGLA

(100%)%Mult. CAPEX

InvestedCAPEX

KeyMoney

NOI 1st

yearNOI 3rd

year3rd year

NOI Yield

1 ParkShoppingSoCaetano Nov-11 38,661 m 100.0% 250,134 79% 37,130 35,296 47,746 22.4%

2 JundiaShopping Oct-12 35,820 m 100.0% 270,114 37% 24,570 28,165 34,649 14.1%

3 VillageMall Nov-12 25,580 m 100.0% 410,000 48% 39,083 39,659 45,362 12.2%

4 ParkShoppingCampoGrande 1 Nov-12 42,099 m 90.0% 215,490 15% 43,310 24,209 32,511 18.9%

5 Parque Shopping Macei 2Q-13 36,092 m 50.0% 93,333 9% 9,259 10,432 13,184 15.7%

Total 178,252 m 89.9% 1,239,071 43% 153,352 137,761 173,452 16.0%

JundiaShopping (SP)in 2Q11

ParkShoppingCampoGrande (RJ)in 2Q11

VillageMall (RJ)in 2Q11

Delivered to tenants in 2Q11ParkShoppingSoCaetano (SP)

-

8/6/2019 Apresentao2Q11ENG

11/14

2Q11

11

New Projects Under Development

OfficeTowers for Lease Under Development

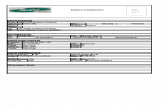

Office Towers for Lease Multiplans Interest (R$000)

Project Opening GLA (100%) %Mult. CAPEXInvestedCAPEX

StabilizedNOI

StabilizedNOI Yield

Morumbi Business Center Jan-12 10,635 m 100.0% 73,946 58% 11,486 15.5%

ParkShopping Corporate Nov-12 13,360 m 50.0% 38,444 11% 7,152 18.6%

Morumbi Corporate Sep-13 74,198 m 100.0% 445,759 24% 83,701 18.8%

Total 98,193 m 93.2% 558,149 28% 102,339 18.3%

Morumbi Business Center (SP)

in 2Q11

ParkShopping Corporate (DF)

Project Illustration

Morumbi Corporate (SP)

Project Illustration

-

8/6/2019 Apresentao2Q11ENG

12/14

2Q11

Office Towers for Sale

Project Opening Area %Mult.PSV1

(R$`000)

Cristal Tower Aug-11 11,912 m 100.0% 82,237

Centro Profissional RBS Dec-12 12,563 m 100.0% 75,040

Total 24,475 m 100.0% 157,277

12

New Projects Under Development

Office Towers for Sale

1 Potential Sales Value

Cristal Tower (RS)in 2Q11

Centro Profissional RibeiroShoppingin 2Q11

Cristal Tower skywalk toBarraShoppingSul

-

8/6/2019 Apresentao2Q11ENG

13/14

2Q11

13

New Projects Under Development

Expected Additional NOI from 8 Projects Under Development... ...Value Creation for Shareholders

1

1 (NOI LTM + Key Money LTM) / (Multiplan s Market Cap on June 30th, 2011 + Multiplan Net Cash Position on June 30th, 2011)2 (NOI LTM + Key Money LTM) / (Multiplan s Market Cap on August 09 th, 2011 + Multiplan Net Cash Position on June 30th, 2011)

3 New Projects for Lease 3rd Year NOI / (New Projects for Lease CAPEX New Projects for Lease Key Money)

Projects for Lease

278.4 M

+58.7 M

+105.6 M

+97.1 M

+11.2 M

5.8 M

64.5 M

170.1 M

267.2 M

2011E 2012E 2013E 2014E 2015E2 3

8.2%9.3%

16.8%

Multipl an's Cap Rateon 30/Jun/2011

Multiplan's Cap Rateon 9/Aug/2011

New Projects CapRate

-

8/6/2019 Apresentao2Q11ENG

14/14

2Q11

This document may contain prospective statements, which are subject to risks and uncertainties as they were based on expectations of the Companys management and on theinformation available. These prospects include statements concerning our managements current intentions or expectations. Readers/investors should be aware that manyfactors may mean that our future results differ from the forward-looking statements in this document. The Company has no obligation to update said statements. The words"expect, foresee, intend, "plan and similar words are intended to identify affirmations. Forward-looking statements refer to future events which may or may not occur. Ourfuture financial situation, operating results, market share and competitive positioning may differ substantially from those expressed or suggested by said forward-lookingstatements. Many factors and values that can establish these results are outside the companys control or expectation. The reader/investor is encouraged not to completely rely

on the information above. This document also contains information on future projects which could differ materially due to market conditions, changes in law or governmentpolicies, changes in operational conditions and costs, changes in project schedules, operating performance, demand by tenants and consumers, commercial negotiations orother technical and economic factors.

Disclaimer

IR Contact

Armando dAlmeida Neto

CFO and Investors Relation Director

Rodrigo KrauseInvestor Relations Superintendent

Leonardo OliveiraInvestor Relations Senior Analyst

Franco CarrionInvestor Relations Analyst

Diana LitweskiInvestor Relations Analyst

Hans MelchersPlanning Manager

Tel.: +55 (21) 3031-5224Fax: +55 (21) 3031-5322E-mail: [email protected]

http://www.multiplan.com.br/ri