AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

-

Upload

bruno-thiebaut -

Category

Documents

-

view

224 -

download

0

Transcript of AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

1/43

INCT-if INTERNATIONAL WORKSHOPS

ON PHARMACEUTICAL R&DMdulo 4: Valorao de Empresas e Produtos - PARTE 1/2

Recife: 02 de abril de 2012So Paulo + Hubs de webconferncia*: 04 de abril de 2012

*Belm | Belo Horizonte | Braslia | Campinas | Curitiba | Florianpolis | Fortaleza | GoiniaJoo Pessoa | Manaus | Porto Alegre | Ribeiro Preto | Rio de Janeiro | Salvador

Palestrantes:

Patrik Frei, PhD

Fundador e CEO da Venture Valuation AG (Sua), empresa de consultoria especializada na prestao deservios de avaliao e valorao de empresas com elevado potencial de crescimento. Tambm produtora emantenedora da base de dados Biotechgate. Patrik autor dos livros Assessment and Valuation of highgrowth companies, Starting a Business in the Life Sciences: From Idea to Market e Building Biotechnology:

Starting, Managing, and Understanding Biotechnology Companies, bem como de inmeros artigos sobrevalorao, incluindo publicaes na Nature Biotechnology e Chimia. Anteriormente, foi CFO de empresaglobal no segmento de logstica e atuou em empresas de vrios pases. Graduado em Negcios pelaUniversidade de St. Gallen e Doutorado pelo Swiss Federal Institute of Technology, EPFL Lausanne.Recentemente, foi nominado como uma das 20 pessoas mais influentes no setor de cincias da vida, na Sua,pela revista de negcios Bilan, ao lado de indivduos notveis como Ernesto Bertarelli (Serono), Daniel Vasella(Novartis) e Henry B. Meier (HBM BioVentures).

Johan Ohlsson, MS

Analista de negcios na Venture Valuation AG. Especialista em avaliaes financeiras e estratgicas deempresas emergentes com alta taxa de crescimento. Juntamente com Patrik Frei, tem ministrado workshopsinternacionais em inmeros pases. Anteriormente, ocupou posies de executivo de desenvolvimento denegcios e analista estratgico na empresa Pharmalicensing. Tambm atuou como analista snior doBioseeker Group e como pesquisador na rea de oncologia no Microbiology and Tumor Biology Centre (MTC),KarolinskaInstitutet. Bacharel em Finanas e Mestre em Biologia Molecular pela Universidade de Sdertrn.

Organizao: Patrocnio:

x

Copatrocnio

Apoio:

http://www.cnpem.org.br/http://www.redemineirapi.com/scripts/site/?area=homehttp://www.fipase.org.br/ -

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

2/43

CT-if International Workshops on Pharmaceutical R&D April 2012 1

www.venturevaluation.com

CompanyCompany andand ProductProduct ValuationValuation

forfor PharmaPharma andand BiotechBiotechDr. Patrik Frei | Mr. Johan OhlssonDr. Patrik Frei | Mr. Johan Ohlsson

April 2012 | BrazilApril 2012 | Brazil

Copyright 2012 Venture Valuation. All Rights Reserved.

www.venturevaluation.com

Overview Course

9.00 Welcome & Introduction to Valuation

Assessment of the company prior to Valuation

10.30 Break

11.00 Company Valuation approaches

12.30

Lunch14.00 Case study Company valuation

Product valuation / Deal structure

15.30 Break

16.00 Product valuation / Deal structure

17.00 Q&A, Final discussion and Wrap up

17.30 Closing

Copyright 2012 Venture Valuation. All Rights Reserved. 2

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

3/43

CT-if International Workshops on Pharmaceutical R&D April 2012 2

www.venturevaluation.com

- Determine the value => assessment / valuedrivers

- Main valuation approaches, tools &techniques

- How to value a company

Scope of this course

Copyright 2012 Venture Valuation. All Rights Reserved. 3

www.venturevaluation.com

Mission

Offices Zurich, Europe (Munich, Lisbon, Ireland); NorthAmerica (Toronto, Halifax); Asia (Korea, India)

Collaboration in Brazil: Axonal ConsultoriaTecnolgica Ltda., So Paulo

Employees 7 people in Switzerland

7+ representatives / partners around the world

Scientists and finance experts

6 people in JV India Office

Independent assessment and valuation of

technology driven companies / products in

growth industries

Information services / Life Sciences Databases

Venture Valuation

Copyright 2012 Venture Valuation. All Rights Reserved. 4

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

4/43

CT-if International Workshops on Pharmaceutical R&D April 2012 3

www.venturevaluation.com

Track Record Over 250 valuated companies (world-wide)

Clients Investors, companies, government and academic

institutions

Expertise Finance experts work hand in hand with experienced

industry specialists (pharma, biotechnology, medical

technology and high-technology)

Products - Valuation Reports

- Licensing Candidate Search- Portfolio Valuation

Approach Workshop with company on site

COMPANY | PRODUCTS & SERVICES | SERVIC ES | VALUATION PROCESS | METHODS | BIOTECHGATE.COM | TEAM | ADVISORY BOARD | STATISTICS | REFERENCES | SCIENTIFIC BASIS | LOCATIONS

Valuation Service

Copyright 2012 Venture Valuation. All Rights Reserved. 5

www.venturevaluation.com

In total there are over 23000 companies in the database.

CountryBiotechTherap

Biotech -R&D Ser

Biotechrelated

PharmaMed-tech

www.Austrianbiotech.com 26 48 12 14 20

www.Canadianlifesciences.com 150 192 256 64 104

www.Frenchbiotech.com79 220 59 27 53

www.Germanbiotech.com 139 542 152 59 226

www.Indianbiotech.com 17 148 152 44 10

www.Italianbiotech.com 65 250 237 100 155

www.Scandinavianlifesciences.com 154 268 96 56 390

www.Swisslifesciences.com 90 166 61 60 352

www.Usalifesciences.com 1085 967 214 154 798

Total (www.biotechgate.com) 2346 3939 1792 996 2652

Biotechgate.com

Copyright 2012 Venture Valuation. All Rights Reserved. 6

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

5/43

CT-if International Workshops on Pharmaceutical R&D April 2012 4

www.venturevaluation.com

Partners Biotechgate.com

Copyright 2012 Venture Valuation. All Rights Reserved. 7

www.venturevaluation.com

Brazilianlifesciences.com

Copyright 2012 Venture Valuation. All Rights Reserved. 8

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

6/43

CT-if International Workshops on Pharmaceutical R&D April 2012 5

www.venturevaluation.com

Basics of Valuation?

Why?

When?

What?

Copyright 2012 Venture Valuation. All Rights Reserved. 9

www.venturevaluation.com

1.5 m

75%

0.5 m

25%

Pre-money value

Investment

- Value before investment (pre -money value): EUR 1,5 m

- Investment: EUR 0,5 m

- Value after investment(post-money value):EUR 2,0 m

- Share Investor:0,5 m / 2 m = 25%

Why Valuation

Copyright 2012 Venture Valuation. All Rights Reserved. 10

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

7/43

CT-if International Workshops on Pharmaceutical R&D April 2012 6

www.venturevaluation.com

- Out-licensing of a phase II product

- Deal terms: up-front CHF 1 mmilestones CHF 20 mroyalties 7%

- rNPV of product ?

- rNPV of deal ?

rNPV of product: CHF 30 m rNPV of deal: CHF 10 m

Splitt Biotech / Pharma: 33% / 66%

rNPV: risk adjusted net present value

Why Valuation

Copyright 2012 Venture Valuation. All Rights Reserved. 11

www.venturevaluation.com

- Think ahead

- Be prepared for negotiations

- Know the fundamentals

- What assumptions have been used

- Out-licensing or financing round?

=> On going exercise

When do a Valuation?

Copyright 2012 Venture Valuation. All Rights Reserved. 12

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

8/43

CT-if International Workshops on Pharmaceutical R&D April 2012 7

www.venturevaluation.com

Valuation of what?

1. Valuation of a product

Licensing deal

Strategic development decision

2. Valuation of a company

Investment / Financing round

Merger / Acquisition

Measure success of companydevelopment

Copyright 2012 Venture Valuation. All Rights Reserved. 13

www.venturevaluation.com

Definitions

Value: implies the inherent worth of aspecific thing

Price: depending on the market (supply /demand); whatever somebody is preparedto pay

Price is what you pay. Value is what you get.By Warren Buffett

Copyright 2012 Venture Valuation. All Rights Reserved. 14

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

9/43

CT-if International Workshops on Pharmaceutical R&D April 2012 8

www.venturevaluation.com

Rational on Valuation

Why assessment and valuation of high

growth companies?

- Industry lacks transparency

- Valuation is key issue in development

- Very difficult (high uncertainties)

- High potential for investors

- Long investment cycle- Traditional valuation methods unsuited

- Complex technology and IP situations

Copyright 2012 Venture Valuation. All Rights Reserved. 15

www.venturevaluation.com

Mind-set of Investors

Take high risk, but expect high returns

Pressure from investors

Compete in capital market

Probability of failure Return

Government Bond 0% 3%

Bonds 5% 5%

Blue Chip Company 10% 9%

Internet company (Nasdaq) 50% 20%

Biotechnology Company 80% 50%

Copyright 2012 Venture Valuation. All Rights Reserved. 16

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

10/43

CT-if International Workshops on Pharmaceutical R&D April 2012 9

www.venturevaluation.com

Mindset of Investors

Example Risk of failure of 80% (4 out of 5):

5 companies, investment of EUR 1 meach

One successful, 4 total loss

The successful company must financethe others (5 * EUR 1 m plus adequatereturn)

Copyright 2012 Venture Valuation. All Rights Reserved. 17

www.venturevaluation.com

Venture Capital Cycle

FF&F

Understand the Venture Capital Cycle

Look at the wholeCompanyLife Cycle

IPO,

Trade sale

Series CSeries BSeries A

VC

InvestmentExit

Required IRRRequired IRR

Venture Capital

Investment Cycle

Copyright 2012 Venture Valuation. All Rights Reserved. 18

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

11/43

CT-if International Workshops on Pharmaceutical R&D April 2012 10

www.venturevaluation.com

VC Investment Process

Deal

flow

Moni-

toringExit

Access to

projects

Reporting and

support

Divesting and

generatingreturnDecision making and negotiations

Initial

screening

Due

Diligence /

Assessment

Negotiation

Valuation

Copyright 2012 Venture Valuation. All Rights Reserved. 19

www.venturevaluation.com

Exit possibilities

Investor look for exit possibilities torealize return

Sale of shares => very difficult

Exit via different channels possible: Merger & Acquisition (M&A)

Management Buy-out (MBO)

Initial Public Offering (IPO)

Copyright 2012 Venture Valuation. All Rights Reserved. 20

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

12/43

CT-if International Workshops on Pharmaceutical R&D April 2012 11

www.venturevaluation.com

Mind-set of Pharma

Fuel pipeline

Portfolio approach

Compete with Investors

Collaboration vs. acquisition

Are dependent on Biotech

Tend to get involved earlier

Copyright 2012 Venture Valuation. All Rights Reserved. 21

www.venturevaluation.com

Risk vs. Return

Product on

the market

Risk

ExpectedReturn

Pre-clinical

Phase I

Phase II

Phase III

Government

Bond

Public Market

Venture Capital

Copyright 2012 Venture Valuation. All Rights Reserved. 22

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

13/43

CT-if International Workshops on Pharmaceutical R&D April 2012 12

www.venturevaluation.com

Biotech vs. Dow Jones

Copyright 2012 Venture Valuation. All Rights Reserved. 23

www.venturevaluation.com

Riskpremium vs. Value

riskless rate of

return

Systematic risk

Liquidity

ValueAdded

CashFlowAdjustment

Seed Start-up First Stage Expansion Stage IPO

Leads Pre-clinical Phase I Phase II phase III

Discountr

ate

Companyvalue

Copyright 2012 Venture Valuation. All Rights Reserved. 24

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

14/43

CT-if International Workshops on Pharmaceutical R&D April 2012 13

www.venturevaluation.com

Risk as a major factor

1. What is risk?

2. How can we capture risk?

3. How can risk be quantified?

Copyright 2012 Venture Valuation. All Rights Reserved. 25

www.venturevaluation.com

What is Risk?

The quantifiable likelihood of loss or less-than-expected returns. (source: investorwords.com)

If outcomes will occur with known orestimable probability, the decisionmakerfaces a risk. Certainty is a special case ofrisk in which this probability is equal to zeroor one. (source: about.com)

Copyright 2012 Venture Valuation. All Rights Reserved. 26

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

15/43

CT-if International Workshops on Pharmaceutical R&D April 2012 14

www.venturevaluation.com

Risk as a major factor

1. What is risk?

2. How can we capture risk?=> Assessment of the company

3. How can risk be quantified?=> rating of factors

Copyright 2012 Venture Valuation. All Rights Reserved. 27

www.venturevaluation.com

From risk to assessment

1. Understand the fundamentals

2. Assumptions drive the valuation

=> assessment is key

Assessment:

1. Management

2. Market

3. Technology

Copyright 2012 Venture Valuation. All Rights Reserved. 28

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

16/43

CT-if International Workshops on Pharmaceutical R&D April 2012 15

www.venturevaluation.com

Overview Course

9.00 Welcome & Introduction to Valuation

Assessment of the company prior to Valuation

10.30 Break

11.00 Company Valuation approaches

12.30 Lunch14.00

Case study Company valuation

Product valuation / Deal structure

15.30 Break

16.00 Product valuation / Deal structure

17.00 Q&A, Final discussion and Wrap up

17.30 Closing

Copyright 2012 Venture Valuation. All Rights Reserved. 29

www.venturevaluation.com

Assessment

Why is assessment important?

Valuation is all about assumptions

Understand the risk

Quantify the risk

Different perception of company

Copyright 2012 Venture Valuation. All Rights Reserved. 30

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

17/43

CT-if International Workshops on Pharmaceutical R&D April 2012 16

www.venturevaluation.com

Valuation Framework

Management

riskfree base rate

systematicrisk premium

LiquidityPremium

ValueAdded

CashFlowAdjustment

Seed Start-up First Stage Expansion Stage IPO

discountrate

Company Stage

Market

Science &

Technology

Qualitative Analysis

(Softfactors)Risk Analysis Quantitative Analysis

Valuation

Copyright 2012 Venture Valuation. All Rights Reserved. 31

www.venturevaluation.com

Value Drivers

Soft factors are essential ...

- Management

- Market

- Science & Technology

... and the company stage

to define the risk profile of company

Management

riskfreebaserate

systematicriskpremium

LiquidityPremium

ValueAdded

CashFlowAdjustment

Seed Start-up FirstStage Expansion Stage IPO

discountrate

Company Stage

Market

Science &

Technology

Qualitative Analysis

(Softfactors)Risk Analysis QuantitativeAnalysis

Valuation

Copyright 2012 Venture Valuation. All Rights Reserved. 32

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

18/43

CT-if International Workshops on Pharmaceutical R&D April 2012 17

www.venturevaluation.com

Management

1. Completeness skills

2. Track record / experience

3. Motivation / Incentive structure

4. Organization

5. Emotional intelligence / social

competence

6. Composition and involvement of

boards

highgoodsufficentinsufficentlow /

poor

none /

very poor

1 2 3 4 5 6

Copyright 2012 Venture Valuation. All Rights Reserved. 33

www.venturevaluation.com

Market Environment

Industry Structure: (Five forces by Michael Porter)

1. Threat of new Entry

2. Rivalry among existing competitors

3. Pressure from substitute products

4. Dependencies on customers5. Dependencies on suppliers

6. Current and future market potential

7. Customers

8. Political / legal dependencies

9. Cost and Sales estimations

highgoodsufficentinsufficentlow /

poor

none /

very poor

1 2 3 4 5 6

Copyright 2012 Venture Valuation. All Rights Reserved. 34

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

19/43

CT-if International Workshops on Pharmaceutical R&D April 2012 18

www.venturevaluation.com

Sciences & Technology

1. Intellectual Property (IP)

2. Unique selling proposition

3. Alliances/partnerships

4. Management of future

discoveries

5. Time to market

highgoodsufficentinsufficentlow /

poor

none /

very poor

1 2 3 4 5 6

Copyright 2012 Venture Valuation. All Rights Reserved. 35

www.venturevaluation.com

Company stages

source: Schmidtke.

Copyright 2012 Venture Valuation. All Rights Reserved. 36

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

20/43

CT-if International Workshops on Pharmaceutical R&D April 2012 19

www.venturevaluation.com

risklessrateofreturn

Systematicrisk

Liquidity

ValueAdded

CashFlowAdjustment

S ee d S ta rt -u p F ir st S t ag e E xp an si on S ta ge I PO

Discountrate

highgoodsufficentinsufficentlow /

poor

none /

very poor

1 2 3 4 5 6

earlystage

seed

financing

start up

financing

firststage

financing

expansionstage devesting

secondst.

financing

later

stage

profit

loss

Venturephase

Assessment / Rating

Discount rate

Adjustment factor

for relative

valuations

From Rating to Valuation

Copyright 2012 Venture Valuation. All Rights Reserved. 37

www.venturevaluation.com

Rating - Assessment

- Management (rating 1-6)

- Market (rating 1-6)

- Product, Sciences & Technology (rating 1-6)

Score to determine at upper or lower end

of spectrum

Start-up Stage: 50% to 70%

Score Discount rate

above 95 => 50% - 55%

70 95 => 55% - 60%

45 70 => 60% - 65%

below 45 => 65% - 70% Copyright 2012 Venture Valuation. All Rights Reserved. 38

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

21/43

CT-if International Workshops on Pharmaceutical R&D April 2012 20

www.venturevaluation.com

Overview Course

9.00 Welcome & Introduction to Valuation

Assessment of the company prior to Valuation

10.30 Break

11.00 Company Valuation approaches

12.30 Lunch14.00

Case study Company valuation

Product valuation / Deal structure

15.30 Break

16.00 Product valuation / Deal structure

17.00 Q&A, Final discussion and Wrap up

17.30 Closing

Copyright 2012 Venture Valuation. All Rights Reserved. 39

www.venturevaluation.com

Valuation Methods

Content

- Introduction Methods

- Discounted Cash Flow- Other Valuation approaches- Example

Copyright 2012 Venture Valuation. All Rights Reserved. 40

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

22/43

CT-if International Workshops on Pharmaceutical R&D April 2012 21

www.venturevaluation.com

- Often no revenues / earnings

- Value = potential of the future andassociated risk

- Influence factors:

Management

Market

Science and Technology

Stage of company

High growth Companies

Copyright 2012 Venture Valuation. All Rights Reserved. 41 Copyright 2012 Venture Valuation. All Rights Reserved.

www.venturevaluation.com

Valuation Approaches

Operations-based methods:business plan, fundamentals

Market methods

Operations methods

Mixed method

Market-based methods:price, trends, comparison difficulties

Discounted Cash Flows (DCF)

rNPV* Method

Real Options

Venture Capital method

Market Comparables

Comparable Transactions

* rNPV: risk adjusted net present value) Copyright 2012 Venture Valuation. All Rights Reserved. 42

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

23/43

CT-if International Workshops on Pharmaceutical R&D April 2012 22

www.venturevaluation.com

- Cash Flow based Method (DCF)

- Relative valuation Method

- Venture Capital / Exit based Method

- rNPV Method

- Option pricing Method

=> there is no the right method

=> combination of different methods

Used Methods

Copyright 2012 Venture Valuation. All Rights Reserved. 43 Copyright 2012 Venture Valuation. All Rights Reserved.

www.venturevaluation.com

Valuation Methods

Content

- Introduction Methods

- Discounted Cash Flow- Other Valuation approaches- Example

Copyright 2012 Venture Valuation. All Rights Reserved. 44

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

24/43

CT-if International Workshops on Pharmaceutical R&D April 2012 23

www.venturevaluation.com

Discounted Cash Flow

- Machine to produce one 100 USD bill in 3years

- Risk = 0

- Discount rate = 8% (time value of money)

- No input needed

Value of machine?

(one time in year 3) (every year)

100 100

(1.08)3 0.0879.4 1250

Copyright 2012 Venture Valuation. All Rights Reserved. 45

www.venturevaluation.com

Basic DCF

Copyright 2012 Venture Valuation. All Rights Reserved. 46

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

25/43

CT-if International Workshops on Pharmaceutical R&D April 2012 24

www.venturevaluation.com

Discounted Cash Flow

Determine Free Cash Flows for year 1 to 5 or 3/10

Calculate Terminal Value

Discount with Discount Rate

Sum of Free Cash Flows$$$$4

FCF

1

Terminal Value

2

Discount to PV

3

Add FCF

Copyright 2012 Venture Valuation. All Rights Reserved. 47

www.venturevaluation.com

Free Cash Flow

Determine Free Cash Flows for year 1 to 5 or 3/10

Revenues

- Costs

- Depreciation

= Earning before interest and tax (EBIT)- Taxes

= Operating Profit

+ Depreciation

= Cash Flow

- Investments

- Change in Working Capital

= Free Cash Flow (FCF)

FCF

1

Terminal Value

2

Discount to PV

3

$$$$4

Add FCF

Copyright 2012 Venture Valuation. All Rights Reserved. 48

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

26/43

CT-if International Workshops on Pharmaceutical R&D April 2012 25

www.venturevaluation.com

Calculate Terminal Value

a) Normalized Free Cash Flow (nFCF):

last year as basis plus growth rate(estimate: nFCF = FCF5*(1+g))

b) Terminal value (TV):

perpetuity based on nFCF & growth rateTV = nFCF d: discount rate

(d-g) g: growth rate

Growth rate (g): industry long-term growth

Discount to PV

3

$$$$4

Terminal Value

2

FCF

1

Add FCF

Copyright 2012 Venture Valuation. All Rights Reserved. 49

www.venturevaluation.com

Discount rate

Assumptions: interest rate i=10%

today (K0) future (K1) (n=5 years)

1.00 EUR 1.61 EUR K0(1+i)n

0.62 EUR 1.00 EUR K1/(1+i)

n

Content of the discount-rate:

- Depreciation of currency and

- Risk => Qualitative analyzes

=> = 1.6 X

FCF

1

Terminal Value

2

$$$$4

Discount to PV

3

Add FCF

Copyright 2012 Venture Valuation. All Rights Reserved. 50

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

27/43

CT-if International Workshops on Pharmaceutical R&D April 2012 26

www.venturevaluation.com

Discount rate

Discount rate:

- 1) Time value of money (risk free rate)

- 2) Risk of getting the money back

- Risk of Equity Risk of Debt

Risk can be measured in different ways:

- Credit Rating

- Rating (Moodys) => Assessment

- Attrition rate for product development

- Volatility of stock

- Company stage

FCF

1

Terminal Value

2

$$$$4

Discount to PV

3

Add FCF

Copyright 2012 Venture Valuation. All Rights Reserved. 51

www.venturevaluation.com

Discount rate

a) Company stage

1 Seed Stage leads 70% to 90% (20x)*

2 Start-up Stage pre-clinical 50% to 70% (10x)*

3 First Stage phase I 40% to 60% (8x)*4 Second Stage phase II 35% to 50% (6x)*

5 Later Stage phase III 25% to 40% (5x)*

*X-times the investment in 5 years necessary => (1+80%) 5 = 19x

b) Rating based

=> Determine area within range

FCF

1

Terminal Value

2

$$$$4

Discount to PV

3

Add FCF

Copyright 2012 Venture Valuation. All Rights Reserved. 52

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

28/43

CT-if International Workshops on Pharmaceutical R&D April 2012 27

www.venturevaluation.com

WACC - Discount rate

WACC: weighted average cost of capital

Cost of equity: 50%

Cost of debt: 15%

Equity ratio: 0.8

Debt ratio: 0.2

WACC: 0.8*50% + 0.20*15% = 43%

FCF

1

Terminal Value

2

$$$$4

Discount to PV

3

Add FCF

Copyright 2012 Venture Valuation. All Rights Reserved. 53

www.venturevaluation.com

Sum of FCF (NPV)

FCF

1

Terminal Value

2

Discount to PV

3

$$$$4

In 1000 EUR Year 1 Year 2 Year 3 Year 4 Year 5 TV

FCF -99 76 126 137 128 500

formula-99 76 126 137 128 500

(1.35)1 (1.35)2 (1.35)3 (1.35)4 (1.35)5 (1.35)5

PV -73 42 51 41 29 112

Total (sum) 201

Add FCF

Copyright 2012 Venture Valuation. All Rights Reserved. 54

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

29/43

CT-if International Workshops on Pharmaceutical R&D April 2012 28

www.venturevaluation.com

Valuation Methods

Content

- Introduction Methods- Discounted Cash Flow- Other Valuation approaches- Example

Copyright 2012 Venture Valuation. All Rights Reserved. 55

www.venturevaluation.com

Liquidation value

- Machine made of pure silver

- weights exactly 30 ounce

- Silver: USD 15 / ounce

Value of machine?

Liquidation value: 450 USD

Continue use: 1250 USD

Copyright 2012 Venture Valuation. All Rights Reserved. 56

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

30/43

CT-if International Workshops on Pharmaceutical R&D April 2012 29

www.venturevaluation.com

Relative Value

- no known market price for silver

- similar USD 100-machines have traded

- 9 and 15 times their estimated annualoutput

Value of machine?

=> Value range 900 USD to 1500 USD

Copyright 2012 Venture Valuation. All Rights Reserved. 57

www.venturevaluation.com

Market Comparable

Ratio

Revenues

Earnings

EBITDA

Employees

Companyspecificfactors

Company Value:EUR 10 m

50 employees

10 employees

Company Value:

EUR 2 m*

* (10/50) x 10 m = 2 m

Copyright 2012 Venture Valuation. All Rights Reserved. 58

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

31/43

CT-if International Workshops on Pharmaceutical R&D April 2012 30

www.venturevaluation.com

Exit value (VC Method)

- Value of machine in 5 years is 1800 USD

- Machine will produce USD bills from year 6

- 50% probability machine will break in first 5years

Value of machine?

=> USD 1800 * 50% = 900 USD

Copyright 2012 Venture Valuation. All Rights Reserved. 59

www.venturevaluation.com

VC method

Present

Value

today

Present

year 1 Exit year

Future

Exit

Value

Copyright 2012 Venture Valuation. All Rights Reserved. 60

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

32/43

CT-if International Workshops on Pharmaceutical R&D April 2012 31

www.venturevaluation.com

Summary Methods

Cash flow based 1250

Market comparable 900 - 1500

Exit value 900

Average (value) 1017 - 1217

Price vs. Value:

1. Collector is prepared to pay 16002. Nobody is interested

Copyright 2012 Venture Valuation. All Rights Reserved. 61

www.venturevaluation.com

Valuation Methods

Content

- Introduction Methods

- Discounted Cash Flow- Other Valuation approaches- Example

Copyright 2012 Venture Valuation. All Rights Reserved. 62

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

33/43

CT-if International Workshops on Pharmaceutical R&D April 2012 32

www.venturevaluation.com

Valuation of Bio-tech AG

Company founded 2002

Service company

Screening for Biotech companies

First revenues from screening services

Requires investment of: EUR 100000

Financing stage: First Stage

Valuation according to DCF method

EXAMPLE Bio-tech AG

Copyright 2012 Venture Valuation. All Rights Reserved. 63

www.venturevaluation.com

Data of Bio-tech AG

Good, experienced management

Medium market size, little expansion possibilities /

ambition

Product innovation small, me-too, inexpensiveproduction

Qualitative analyses produces the following data:

Discount rate (d): 35% (medium risk)

Growth rate (g): 7%

EXAMPLE Bio-tech AG

Copyright 2012 Venture Valuation. All Rights Reserved. 64

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

34/43

CT-if International Workshops on Pharmaceutical R&D April 2012 33

www.venturevaluation.com

Revenues + 240

Costs - 239

Profit / Cash Flow = 1

Investments - 100

Free Cash Flow (FCF) = -99

Year 1

EXAMPLE Bio-tech AG

Copyright 2012 Venture Valuation. All Rights Reserved. 65

www.venturevaluation.com

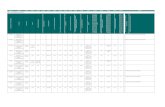

Liquidity plan year 1 year 2 year 3 year 4 year 5

Revenues Service 1 + 240 320 410 430 510

Revenues Service 2 + 75 120 190 210

Revenues total = 240 395 530 620 720

Material + 96 158 212 248 288

Staff + 105 105 131 157 209

Marketing + 10 10 10 15 15

Lease, Infrastructure + 18 18 18 18 18

others + 10 8 8 10 12

Costs total = 239 299 379 448 542

Profit / Cash Flow = 1 96 151 172 178

Investments - 100 20 25 35 50

Free Cash Flow (FCF) = -99 76 126 137 128

EXAMPLE Bio-tech AG

Copyright 2012 Venture Valuation. All Rights Reserved. 66

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

35/43

CT-if International Workshops on Pharmaceutical R&D April 2012 34

www.venturevaluation.com

Calculation of Continuing value (CV)

nFCF from year 6*: 140000

Terminal value (TV): 500000

Calculation(with d = 35%; g = 7%):

* estimated based on year 5

CV =nFCF(d-g)

=140000

(0.35-0.07)= 500000

EXAMPLE Bio-tech AG

Copyright 2012 Venture Valuation. All Rights Reserved. 67

www.venturevaluation.com

In 1000 EUR Year 1 Year 2 Year 3 Year 4 Year 5 CV

FCF -99 76 126 137 128 500

formula

-99 76 126 137 128 500

(1.35)1 (1.35)2 (1.35)3 (1.35)4 (1.35)5 (1.35)5

PV -73 42 51 41 29 112

total (sum) 201

FCF: Free Cash Flow

CV: Continuing value

Bio-tech AG

Copyright 2012 Venture Valuation. All Rights Reserved. 68

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

36/43

CT-if International Workshops on Pharmaceutical R&D April 2012 35

www.venturevaluation.com

100

33.2%201

66.8%

Pre-money

Value

Investment

Implication for investment

Company value (pre-money)is around EUR 201000

Investor receives around33% of the company forhis investment of 100000

The founders willhave around 67%

Value of Bio-tech AG

Copyright 2012 Venture Valuation. All Rights Reserved. 69

www.venturevaluation.com

Overview Course

9.00 Welcome & Introduction to Valuation

Assessment of the company prior to Valuation

10.30 Break

11.00 Company Valuation approaches

12.30

Lunch14.00 Case study Company valuation

Product valuation / Deal structure

15.30 Break

16.00 Product valuation / Deal structure

17.00 Q&A Final discussion and Wrap up

17.30 Closing

Copyright 2012 Venture Valuation. All Rights Reserved. 70

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

37/43

CT-if International Workshops on Pharmaceutical R&D April 2012 36

www.venturevaluation.com

Case Study Glycart

- Glycart acquired by Roche in July 2005

- For USD 180 m

- Swiss company; founded in 2000 spin-offfrom ETH in Zurich

- Technology platform to enhance the activityof therapeutic antibodies (cancer /autoimmune diseases)

- Pre-clinical products

- Existing collaboration with Roche (1 year)

- 30 employees

Copyright 2012 Venture Valuation. All Rights Reserved. 71

www.venturevaluation.com

- Raise USD 31 m in the past

- Planned to raise another USD 35 m =>valuation too low

- Acquisition offer by mid-sized Pharma

auction process / parallel fund raising

Case Study Glycart

Copyright 2012 Venture Valuation. All Rights Reserved. 72

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

38/43

CT-if International Workshops on Pharmaceutical R&D April 2012 37

www.venturevaluation.com

Valuation:

Pre-clinical compounds USD 180 m?

Technology Platform?

Keeping control?

Value enhancementfor own products?

Value

Value

Synergies

Pricepa

id

USD

Case Study Glycart

Copyright 2012 Venture Valuation. All Rights Reserved. 73

www.venturevaluation.com

Case Study GeneData

1. Assess Genedata according to grid

2. Perform Valuation of Genedata

3. Decide if you would buy shares (yes / no)

Copyright 2012 Venture Valuation. All Rights Reserved. 74

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

39/43

CT-if International Workshops on Pharmaceutical R&D April 2012 38

www.venturevaluation.com

Introduction Case Study

Portfolio Company

InvestorValuation Advisor

Case Study1. GeneData

2. Novartis Venture Fund

3. Venture Valuation

75 Copyright 2012 Venture Valuation. All Rights Reserved.

www.venturevaluation.com

Gene Data Assessment

- Strong Management, but too focused on sciences ratherthan business

- 1999 as strong market for Bioinformatics

- Sophisticated products, innovative development approach

Weak Medium Strong

Management X

Market X

Science & X

Technology

Copyright 2012 Venture Valuation. All Rights Reserved. 76

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

40/43

CT-if International Workshops on Pharmaceutical R&D April 2012 39

www.venturevaluation.com

Gene Data Stage

- Just to become profitable

- Starting international expansion, product ready

=> First stage financing => discount rate 40% - 60% Copyright 2012 Venture Valuation. All Rights Reserved. 77

www.venturevaluation.com

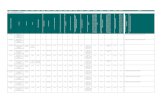

Gene Data Cash Flow

Planned

in USD 000s 2000 2001 2002 2003 2004

Sales 6200 11000 18000 29000 45000

- R&D expenses 1400 2000 2500 3500 4500

- Other Costs 2250 4000 8000 11000 16000- Depreciation 80 80 100 100 100

- Tax 20 50 1850 3600 6100

Net Profit (NOPLAT) 2450 4870 5550 10800 18300

+ Depreciation 80 80 100 100 100

- Change in Working Capital 517 500 583 917 1333

- Investments 80 100 100 100 100

Free Cash Flow (FCF) 1933 4350 4967 9883 16967

Copyright 2012 Venture Valuation. All Rights Reserved. 78

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

41/43

CT-if International Workshops on Pharmaceutical R&D April 2012 40

www.venturevaluation.com

Gene Data assumptions

Some Calculations

- Discount rate (d): 42%

=> based on stage and assessment/risk profile

- Growth rate (g): 15%

=> Based on industry growth

- Normalized FCF (in USD 000s): 17000

=> based on FCF in 2004

- Terminal Value: 62963

=> 17000 / (42%-15%)

Copyright 2012 Venture Valuation. All Rights Reserved. 79

www.venturevaluation.com

Gene Data Valuation

Valuation:

Discount: 1/(1+d)^year

=> 1/(1.42)^5 = 0.173

2000 2001 2002 2003 2004 TV

FCF (in 1'000 $) 1933 4350 4967 9883 16967 62963

Discount 0.704 0.496 0.349 0.246 0.173 0.173

Present value 1'361 2'157 1'735 2'431 2'939 10'905

Value 21528

*

=

Copyright 2012 Venture Valuation. All Rights Reserved. 80

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

42/43

CT-if International Workshops on Pharmaceutical R&D April 2012 41

www.venturevaluation.com

Gene Data Sensitivity

Sensitivity Analysis

Growth rate (g)

Discount (d)11% 13% 15% 17% 19%

38% 24'270 25'277 26'458 27'865 29'567

40% 22'037 22'845 23'781 24'881 26'189

42% 20'121 20'776 21'528 22'401 23'425

44% 18'462 18'999 19'610 20'311 21'125

46% 17'015 17'459 17'960 18'530 19'185

Copyright 2012 Venture Valuation. All Rights Reserved. 81

www.venturevaluation.com

Gene Data Today

- Leading Bioinformatics company

- Still privately owned

- 125 employees

- Locations: Japan / US / Germany / Switzerland (HQ)

- Clients include Pharmaceutical, Agrochemical,Industrial Biotechnology and Non-Profit Research

Organizations

www.genedata.com

Copyright 2012 Venture Valuation. All Rights Reserved. 82

-

8/2/2019 AXONAL Company and Product Valuation (Part I), Brazil April 2012 1.03b

43/43

www.venturevaluation.com

Overview Course

9.00 Welcome & Introduction to Valuation

Assessment of the company prior to Valuation

10.30 Break

11.00 Company Valuation approaches

12.30 Lunch14.00

Case study Company valuation

Product valuation / Deal structure

15.30 Break

16.00 Product valuation / Deal structure

17.00 Q&A, Final discussion and Wrap up

17.30 Closing

Copyright 2012 Venture Valuation. All Rights Reserved. 83