Apresentao1Q11ENG

-

Upload

multiplan-ri -

Category

Documents

-

view

215 -

download

0

Transcript of Apresentao1Q11ENG

-

8/6/2019 Apresentao1Q11ENG

1/12

1Q11

1Q11 Earnings Release

-

8/6/2019 Apresentao1Q11ENG

2/12

1Q11

7.0%

6.6%

6.1%

SAS SSS IPCA

8.2%

12.7%

NationalRetail Sales

(IBGE)

Total Sales

R$1,046 M

R$1,261 M

R$1,586 M

R$1,786 M

1Q08 1Q09 1Q10 1Q11

Shopping Center Sales*

2*Considering 100% of shopping center sales.** Data of Jan and Feb 2011.

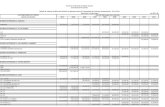

Multiplan Shopping Center Sales vs.National Retail and Inflation (1Q11/1Q10) 1Q Total Sales Evolution

+12.7

%10 yearsCAGR: +17.4%

**

Multiplan Shopping Center Highlights(1Q11/1Q10)

48.9%

41.2%

12.9%

26.4%23.3%

14.1%

Organic Growth GLA Expansion

-

8/6/2019 Apresentao1Q11ENG

3/12

1Q11

90.0 M

105.5 M12.8 M

1.2 M1.5 M

Rent 1Q10 Base Overage Merchand. Rent 1Q11

+16.4% +34.9% +17.2%

3

Rental Revenue Analysis

Same Store Rent Real Growth (YoY) Rental Revenue Growth Analysis (1Q11/1Q10)

5.6%6.7%

8.6%10.7%11.1% 10.0%

7.3%

2.9%

0.2%-0.3%

0.6%

4.0%

7.3%

2.1%

2.2%

2.8%

2.9% 1.9% 3.6%

0.8%

3.4%

3.7% 4.8%

6.0%

7.7%2.8%7.7%

9.0%

11.6%

13.9%

13.2%

14.0%

8.1%

6.5%

3.9%

4.4%

6.6%

12.0%

10.3%

1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11

Real SSR IGP-DI Adjustment Effect

Rental Revenue Growth Breakdown (YoY)1Q11 Gross Revenue Breakdown (%)

Key money5.3%

Parking10.7%

Real estate7.8%

Services11.0%

Base86.1%

Overage4.3%Merchandising

9.7%

Straight line eff ect4.0%

RentalRevenue60.9%

+17.2%

7.3%

+9.8% +10.3%

+17.2%

IGP-DI

AdjustmentEffect

Same Area

Rent

Same Store

Rent

Rental Revenue

-

8/6/2019 Apresentao1Q11ENG

4/12

-

8/6/2019 Apresentao1Q11ENG

5/12

1Q11

86.4 M

105.0 M

67.4%

72.2%

1Q10 1Q11

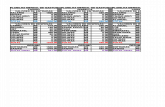

EBITDA Analysis

5

Shopping Center Adjusted EBITDAand Margin (1Q11/1Q10)

Shopping Center EBITDAand Margin (1Q11/1Q10)

Consolidated EBITDAand Margin (1Q11/1Q10)

85.3 M

102.8 M

62.5%

65.2%

1Q10 1Q11

+20.6%

G&A Expenses Evolutionand as a % of Net Revenue

+21.6%+16.9%

+7.8%

20.1 M

25.3 M24.7 M

23.0 M

21.6 M

14.7%

17.7%16.9%

12.9% 13.7%

1Q10 2Q10 3Q10 4Q10 1Q11

92.8 M

108.5 M

72.4%

74.6%

1Q10 1Q11

-

8/6/2019 Apresentao1Q11ENG

6/12

1Q11

47.5 M

63.7 M

34.8%

40.4%

1Q10 1Q11

Adjusted Net Income andAdjusted Net Margin (1Q11/1Q10)

Net Income and Net Margin(1Q11/1Q10)

Adjusted FFO and Margin(1Q11/1Q10)

6

Financial Results

+34.2%

+11.3%

90.3 M

103.1 M

66.2%

65.3%

1Q10 1Q11

+14.2%

79.7 M

88.7 M

58.5%

56.2%

1Q10 1Q11

-

8/6/2019 Apresentao1Q11ENG

7/12

-

8/6/2019 Apresentao1Q11ENG

8/12

1Q11

8

Key Money and New Projects for Lease Expenses

Projects Signed Key Money and NewProjects for Lease Expenses in 1Q11 (R$)

Leasing Evolution

Deferred Income Evolution (R$)

Leasing Status(April, 2011)

15.8 M

3.4 M

Projects Signed Key Money New Projects for LeaseExpenses

86.2%

81.7%

71.5%

54.6%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

4Q09 1Q10 2Q10 3Q10 4Q10 1Q11

LeasedStores

ParkShoppingSoCaetano

VillageMall

ShoppingJundia

ParkShoppingCampoGrande

LeasedStores71.3%

To beLeased28.7%

Number ofStores: 806

81.2M

96.4M110.2M110.5M

121.5M126.3M

138.8M141.2M

137.1M

132.M136.7M

150.M158.5M

183.7M

189.6MDelivery ofprojects

Newprojectslaunched

-

8/6/2019 Apresentao1Q11ENG

9/12

1Q11

9

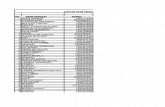

New Project Development

Commercial Towers for Lease

Shopping Centers Under Development

1 Multiplan will own 90% of the Net Operating Income after opening.

Shopping Centers Multiplans Interest (R$000)

Project Opening Status GLA 100% % Mult. CAPEX Key Money NOI 3rd year

ParkShoppingSoCaetano Nov-11 Under Construction 38,661 m 100.0% 250,033 36,022 48,000

JundiaShopping Oct-12 Under Construction 35,655 m 100.0% 270,180 24,873 35,112

VillageMall Nov-12 Under Construction 25,580 m 100.0% 410,000 39,618 45,744

ParkShoppingCampoGrande1 Nov-12 Under Construction 41,878 m 100.0% 215,431 42,785 31,422

Shopping Macei Dec-12 Under Approval 36,405 m 50.0% 91,387 8,445 11,181

Total 178,179 m 89.8% 1,237,031 151,743 171,459

Office Towers for Lease R$ (000)

Project Opening Status GLA 100% % Mult. CAPEX NOI 3rd year

Morumbi Business Center Jan-12 Under Construction 10,635 m 100.0% 73,822 12,762

ParkShopping Corporate Nov-12 Under Construction 13,360 m 50.0% 38,438 7,152

Morumbi Corporate Sep-13 Under Construction 74,198 m 100.0% 445,583 83,701

Total 98,193 m2 93.2% 557,843 103,615

-

8/6/2019 Apresentao1Q11ENG

10/12

1Q11

10

New Project Development

Commercial Towers for Sale

Centro Profissional RBS (SP)Construction site 1Q11

Centro Profissional RBS (SP)Project Illustration

Cristal Tower (RS)

Construction site 1Q11

*Potential Sales Value

Office Towers for Sale R$ (000)Project Opening Area % Mult. PSV*

Cristal Tower Jun-11 11,915 m 100,0% 70.000

Centro Profissional Ribeiro Shopping Dec-12 12,563 m 100,0% 75.040

Total 24,478 m2 100,0% 145.040

-

8/6/2019 Apresentao1Q11ENG

11/12

1Q11

8.2%

16.7%

Multiplan s Cap Rate New Projects Cap Rate

11

New Project Development

Expected Additional NOI from 8 Projects Under Development... ...Value Creation for Shareholder

* **

* (NOI LTM + Key Money LTM) / (Multiplan s Market Cap on March 31st, 2011 + Multiplan Net Cash Position on March 31st, 2011)** New Projects for Lease 3rd Year NOI / (New Projects for Lease CAPEX New Projects for Lease Key Money)

Projects for Lease

+63.3 M

+118.5 M

+79.6 M

5.8 M

69.1 M

187.4 M

265.4 M

2011E 2012E 2013E 2014E

-

8/6/2019 Apresentao1Q11ENG

12/12