WPAC_dissertation

-

Upload

pedro-henriques -

Category

Documents

-

view

124 -

download

1

Transcript of WPAC_dissertation

INSTITUTO SUPERIOR DE ENGENHARIA DE LISBOA

Departamento de Engenharia de Electrónica e Telecomunicações e de Computadores

Dispositivos Móveis no Pagamento de Serviços e

Pedro Miguel Alves Henriques

Dissertação de natureza científica realizada para obtenção do grau deMestre em Engenharia Informática e

Orientadores: Professor-

Júri: Presidente: Coordenador do Mestrado, ISELVogais:

Professor-adjunto Mestre Jorge Sal

INSTITUTO SUPERIOR DE ENGENHARIA DE LISBOA

Departamento de Engenharia de Electrónica e Telecomunicações e de

Dispositivos Móveis no Pagamento de Serviços e

Controlo de Acessos

Pedro Miguel Alves Henriques

(Bacharel)

Dissertação de natureza científica realizada para obtenção do grau deMestre em Engenharia Informática e de Computadores

(Documento Provisório)

-coordenador António Luís Freixo Guedes Osório, ISEL

Coordenador do Mestrado, ISEL

adjunto Doutor Ricardo André Fernandes Costa, ESTGMestre Jorge Sales Gomes, Brisa

Novembro de 2009

Departamento de Engenharia de Electrónica e Telecomunicações e de

Dispositivos Móveis no Pagamento de Serviços e

Dissertação de natureza científica realizada para obtenção do grau de de Computadores

Osório, ISEL

Ricardo André Fernandes Costa, ESTGF

2 Table of Contents

This page is intentionally left blank

3 Table of Contents

Table of Contents

Abstract ............................................................................................................................................................................ 9

Resumo ........................................................................................................................................................................... 10

Introduction .................................................................................................................................................................... 13

Roadmap .................................................................................................................................................................... 15

State of Art ..................................................................................................................................................................... 16

Mobile Payment and Access Control ......................................................................................................................... 16

Payment Solutions ................................................................................................................................................. 16

Access Control Solutions ........................................................................................................................................ 19

Summary ................................................................................................................................................................ 19

Mobile Devices ........................................................................................................................................................... 20

Types and availability ............................................................................................................................................. 20

Mobile phones ....................................................................................................................................................... 20

Operating Systems ................................................................................................................................................. 22

Health issues .......................................................................................................................................................... 23

Wireless Communication ........................................................................................................................................... 23

Mobile Network Telecommunication .................................................................................................................... 23

Short-Range Wireless Communication Technologies ............................................................................................ 24

Security....................................................................................................................................................................... 27

Security Threats and Risks ..................................................................................................................................... 28

Security Properties ................................................................................................................................................. 31

Cryptography ..................................................................................................................................................... 32

Security Solutions .................................................................................................................................................. 36

WPAC Architecture ......................................................................................................................................................... 38

Challenges .................................................................................................................................................................. 38

Usage scenarios .......................................................................................................................................................... 38

Merchant attendance ............................................................................................................................................ 41

Payment amount ................................................................................................................................................... 41

Architecture ............................................................................................................................................................... 41

4 Table of Contents

Roles....................................................................................................................................................................... 41

Relationships .......................................................................................................................................................... 43

Purchase Protocol .................................................................................................................................................. 44

Clearing Protocol.................................................................................................................................................... 46

Lifecycle ...................................................................................................................................................................... 46

Software agent lifecycle ......................................................................................................................................... 47

Payment phases ..................................................................................................................................................... 47

Technology Stack ........................................................................................................................................................ 48

Communication layer ............................................................................................................................................. 48

Contract layer ........................................................................................................................................................ 48

Session layer .......................................................................................................................................................... 49

Application layer .................................................................................................................................................... 49

Dependability ............................................................................................................................................................. 49

WPAC Dynamic risk assessment ..................................................................................................................................... 52

Risk categories............................................................................................................................................................ 53

Low Risk ................................................................................................................................................................. 53

Normal Risk ............................................................................................................................................................ 54

Increased Risk ........................................................................................................................................................ 54

High Risk................................................................................................................................................................. 54

Very High Risk ........................................................................................................................................................ 54

Prohibitive Risk ...................................................................................................................................................... 54

Security credentials .................................................................................................................................................... 54

PIN .......................................................................................................................................................................... 55

Password ................................................................................................................................................................ 55

Voice analysis ......................................................................................................................................................... 56

Iris/face recognition ............................................................................................................................................... 56

Risk factors ................................................................................................................................................................. 56

Payment amount ................................................................................................................................................... 57

Payment repetition ................................................................................................................................................ 58

Time and Place ....................................................................................................................................................... 58

5 Table of Contents

WPAC Security ................................................................................................................................................................ 65

Cryptographic algorithms ........................................................................................................................................... 65

Public-Key Infrastructure ........................................................................................................................................... 65

Secure communication channel ................................................................................................................................. 67

Security properties................................................................................................................................................. 67

Protocol overview .................................................................................................................................................. 68

Messages ............................................................................................................................................................... 69

Secure software agent ............................................................................................................................................... 73

Denial-of-Service ........................................................................................................................................................ 74

WPAC Implementation ................................................................................................................................................... 75

Software packages ..................................................................................................................................................... 75

Libraries ................................................................................................................................................................. 75

Runtime environment ............................................................................................................................................ 76

Purchase Web Service ................................................................................................................................................ 76

Data Model ............................................................................................................................................................ 77

SOAP Messages ...................................................................................................................................................... 77

Bluetooth Binding .................................................................................................................................................. 78

Security Tokens ...................................................................................................................................................... 78

Bluetooth Discovery ................................................................................................................................................... 78

Inquiry time and device discovery ......................................................................................................................... 78

Service search ........................................................................................................................................................ 80

Friendly name search ............................................................................................................................................. 81

Same Bluetooth address ........................................................................................................................................ 82

Connection caching ................................................................................................................................................ 82

Conclusion .............................................................................................................................................................. 83

Cryptographic operations benchmark ....................................................................................................................... 83

Symmetric-key operations ..................................................................................................................................... 83

Asymmetric-key operations ................................................................................................................................... 84

Digital Signatures ................................................................................................................................................... 85

Conclusions ..................................................................................................................................................................... 87

6 Table of Contents

Strengths .................................................................................................................................................................... 87

Weaknesses ................................................................................................................................................................ 87

Opportunities ............................................................................................................................................................. 88

Threats ....................................................................................................................................................................... 88

Future Work ............................................................................................................................................................... 88

Acronyms and abbreviations .......................................................................................................................................... 89

References ...................................................................................................................................................................... 90

Appendix ......................................................................................................................................................................... 95

Purchase Protocol WSDL ............................................................................................................................................ 95

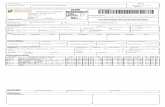

Table of Figures

Figure 1 – Electronic payment scenario overview .......................................................................................................... 14

Figure 2 – Access control scenario overview .................................................................................................................. 15

Figure 3 – Ways to use PayPal Mobile ............................................................................................................................ 16

Figure 4 – P2P-Paid usage scenario ................................................................................................................................ 17

Figure 5 – SET actors ....................................................................................................................................................... 18

Figure 6 – M-Ticket detail ............................................................................................................................................... 19

Figure 7 – Devices mobility and availability .................................................................................................................... 20

Figure 8 – Mobile phone penetration rate in Portugal ................................................................................................... 21

Figure 9 – Mobile phones manufacturers’ Portuguese market share in February 2009 ................................................ 21

Figure 10 – Bluetooth stack protocol ............................................................................................................................. 25

Figure 11 – Mobile Communication Technologies availability on Nokia phones ........................................................... 27

Figure 12 – Security risk assessment and management matrix ..................................................................................... 28

Figure 13 – Digital Signature algorithm .......................................................................................................................... 34

Figure 14 – Public key infrastructure .............................................................................................................................. 35

Figure 15 – Supermarket payment scenario................................................................................................................... 39

Figure 16 – Vending machine payment scenario ........................................................................................................... 39

Figure 17 – Car parking payment scenario ..................................................................................................................... 40

Figure 18 – Street vendor payment scenario ................................................................................................................. 40

Figure 19 – Gas station payment scenario ..................................................................................................................... 40

Figure 20 – WPAC Roles .................................................................................................................................................. 42

Figure 21 – WPAC Relationships ..................................................................................................................................... 43

Figure 22 – Client-Merchant Purchase Protocol ............................................................................................................. 44

7 Table of Contents

Figure 23 – Client-POS Purchase Protocol ...................................................................................................................... 45

Figure 24 – Clearing Protocol ......................................................................................................................................... 46

Figure 25 – M-payment solution lifecycle ...................................................................................................................... 47

Figure 26 – Technology Stack ......................................................................................................................................... 48

Figure 27 – Client-Merchant Purchase Alternative Protocol .......................................................................................... 50

Figure 28 – Risk Levels .................................................................................................................................................... 53

Figure 29 – Security credentials and risk levels .............................................................................................................. 55

Figure 30 – Risk value calculation ................................................................................................................................... 57

Figure 31 – Payment amount division ............................................................................................................................ 57

Figure 32 – Risk table structure ...................................................................................................................................... 64

Figure 33 – WPAC PKI ..................................................................................................................................................... 65

Figure 34 – WPAC registration authority ........................................................................................................................ 66

Figure 35 – Secure communication protocol overview .................................................................................................. 68

Figure 36 – Security tokens exchange ............................................................................................................................ 69

Figure 37 – Client Hello message .................................................................................................................................... 70

Figure 38 – Send Merchant Hello message .................................................................................................................... 70

Figure 39 – Receive Merchant Hello message ................................................................................................................ 71

Figure 40 – Send message .............................................................................................................................................. 72

Figure 41 – Receive message .......................................................................................................................................... 72

Figure 42 – WPAC software packages ............................................................................................................................ 76

Figure 43 – Purchase Protocol data model ..................................................................................................................... 77

Figure 44 – Purchase Protocol WSDL .............................................................................................................................. 78

Figure 45 – Bluetooth inquiry time ................................................................................................................................. 79

Figure 46 – Bluetooth single device discovery time ....................................................................................................... 79

Figure 47 – Bluetooth several devices discovery time ................................................................................................... 79

Figure 48 – Normal Bluetooth Discovery ........................................................................................................................ 80

Figure 49 – Bluetooth Discovery by Friendly Name ....................................................................................................... 81

Figure 50 – Bluetooth device name discovery time ....................................................................................................... 82

Figure 51 – Mean Symmetric cipher engines encryption time ....................................................................................... 84

Figure 52 – Mean symmetric key size encryption time .................................................................................................. 84

Figure 53 – Mean symmetric cipher data size encryption time ..................................................................................... 84

Figure 54 – Mean RSA Encryption time .......................................................................................................................... 85

Figure 55 – Mean RSA Decryption time .......................................................................................................................... 85

Figure 56 – Mean RSA Signature time ............................................................................................................................ 86

Figure 57 – Mean Digital Signature engines sign time ................................................................................................... 86

8 Table of Contents

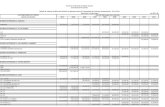

Table of Tables

Table 1 – Short-range wireless communication standards ............................................................................................ 26

Table 2 – Cryptographic algorithms and security properties ......................................................................................... 35

Table 3 – Encryption algorithms application .................................................................................................................. 35

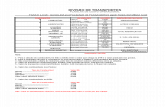

Table 4 – Risk levels values interval ................................................................................................................................ 53

Table 5 – Payment types and risk points ........................................................................................................................ 58

Table 6 – Daily threshold and risk points ........................................................................................................................ 58

Table 7 – Time periods resolution and combinations number ....................................................................................... 59

Table 8 – Countries postal codes format ........................................................................................................................ 60

Table 9 – Postal codes combinations number ................................................................................................................ 61

Table 10 – Portugal postal regions and number of assigned codes ............................................................................... 62

Table 11 – Area code and time period combinations ..................................................................................................... 62

Table 12 – Risk table sizes and download time .............................................................................................................. 62

Table 13 – Risk table example ........................................................................................................................................ 64

Table of Equations

Equation 1 – Risk assessment formula ........................................................................................................................... 64

9 Abstract

Abstract

The swift evolution of mobile devices and wireless communications has transformed the ordinary mobile phone into

a powerful computing device. The need to be permanently connected has increased the dependence of this device,

which is seen as a commodity and carried by the majority of people in urban environment. The ubiquity and

computing capacity of mobile phones increase the interest in the development of wireless services. Mobile phones

may soon become an active element in daily tasks, serving as a payment and access control tool, thus providing new

interfaces for existing services.

The interest shown by stakeholders led to the appearance of several mobile services solutions, which answer to

specific situations and are typically based on closed specifications. The definition of a generic, open and

interoperable architecture is necessary for mobile services widespread adoption. Most wireless payment solutions

rely on mobile network communications, which implies communication costs in all payment transactions and

therefore may have a limited acceptance by clients.

This dissertation proposes and validates an open architecture for payment and access control based on mobile

devices known as WPAC (Wireless Payment and Access Control). This specification uses industrial patterns and

orchestrates security and communication protocols under a web service contract, thus following the Service

Oriented Architecture paradigm. The proof of concept is achieved with the construction of a prototype and tests

realization.

The WPAC architecture enables payments with low operational cost and dynamic risk assessment, requesting the

appropriate set of credentials to the assessed risk. The prototype consists in mobile agent software that implements

the protocol between the client and merchant over a Bluetooth connection.

This open and royalty-free specification together with the strong interest shown by the players provide a good

perspective in terms of solution adoption, which will push forward technology and may simplify people every day

routine.

Keywords: wireless payment, access control, electronic commerce, mobile services, nomadic devices, secure

payment transaction, dynamic risk assessment.

10 Resumo

Resumo

A rápida evolução dos dispositivos móveis e das tecnologias de comunicação sem fios transformou o telemóvel num

poderoso dispositivo de computação móvel. A necessidade de estar permanentemente contactável, comum à

civilização moderna, tem aumentado a dependência deste dispositivo, sendo transportado pela maioria das pessoas

num ambiente urbano e assumindo um papel talvez mais importante que a própria carteira. A ubiquidade e

capacidade de computação dos telemóveis aumentam o interesse no desenvolvimento de serviços móveis, além de

tradicionais serviços de voz. Um telemóvel pode em breve tornar-se um elemento activo nas nossas tarefas diárias,

servindo como um instrumento de pagamento e controlo de acessos, proporcionando assim novas interfaces para

serviços existentes. A unificação de vários serviços num único dispositivo é um desafio que pode simplificar a nossa

rotina diária e aumentar o conforto, no limite deixaremos de necessitar de dinheiro físico, cartões de crédito ou

débito, chaves de residência e de veículos automóveis, ou inclusive documentos de identificação como bilhetes de

identidade ou passaportes.

O interesse demonstrado pelos intervenientes, desde os fabricantes de telemóveis e operadores de rede móvel até

às instituições financeiras, levaram ao aparecimento de múltiplas soluções de serviços móveis. Porém estas soluções

respondem geralmente a problemas específicos, apenas contemplando um fornecedor de serviços ou uma

determinada operação de pagamento, como seja a compra de bilhetes ou pagamento de estacionamento. Estas

soluções emergentes consistem também tipicamente em especificações fechadas e protocolos proprietários. A

definição de uma arquitectura genérica, aberta, interoperável e extensível é necessária para que os serviços móveis

possam ser adoptados de uma forma generalizada por diferentes fornecedores de serviços e para diversos tipos de

pagamento. A maior parte das soluções actuais de pagamento móvel depende de comunicações através da rede

móvel, algumas utilizam o telemóvel apenas como uma interface de acesso à internet enquanto outras possibilitam

o envio de uma SMS (Short Message Service) para autorizar uma transacção, o que implica custos de comunicação

em todas as operações de pagamento. Este custo de operação torna essas soluções inadequadas para a realização

de micropagamentos e podem por isso ter uma aceitação limitada por parte dos clientes. As soluções existentes

focam-se maioritariamente em pagamentos à distância, não tirando partido das características do pagamento

presencial e não oferecendo por isso uma verdadeira alternativa ao modelo actual de pagamento com cartões de

crédito/débito. As capacidades computacionais dos telemóveis e suporte de diversos protocolos de comunicação

sem fio local não têm sido aproveitadas, vendo o telemóvel apenas como um terminal GSM (Global System for

Mobile Communications) e não oferecendo serviços adicionais como seja a avaliação dinâmica de risco ou controlo

de despesas.

Esta dissertação propõe e valida, através de um demonstrador, uma arquitectura aberta para o pagamento e

controlo de acesso baseado em dispositivos móveis, intitulada WPAC (Wireless Payment and Access Control). Para

chegar à solução apresentada foram estudadas outras soluções de pagamento, desde o aparecimento dos cartões de

débito até a era de pagamentos electrónicos móveis, passando pelas soluções de pagamento através da internet. As

capacidades dos dispositivos móveis, designadamente os telemóveis, e tecnologias de comunicação sem fios foram

também analisadas a fim de determinar o estado tecnológico actual. A arquitectura WPAC utiliza padrões de

desenho utilizados pela indústria em soluções de sucesso, a utilização de padrões testados e a reutilização de

11 Resumo

soluções com provas dadas permite aumentar a confiança nesta solução, um desses exemplos é a utilização de uma

infra-estrutura de chave pública para o estabelecimento de um canal de comunicação seguro. Esta especificação é

uma arquitectura orientada aos serviços que utiliza os Web Services para a definição do contracto do serviço de

pagamento. A viabilidade da solução na orquestração de um conjunto de tecnologias e a prova de conceito de novas

abordagens é alcançada com a construção de um protótipo e a realização de testes.

A arquitectura WPAC possibilita a realização de pagamentos móveis presenciais, isto é, junto do fornecedor de bens

ou serviços, seguindo o modelo de pagamento com cartões de crédito/débito no que diz respeito aos intervenientes

e relações entre eles. Esta especificação inclui como aspecto inovador a avaliação dinâmica de risco, que utiliza o

valor do pagamento, a existência de pagamentos frequentes num período curto de tempo, e a data, hora e local do

pagamento como factores de risco; solicitando ao cliente o conjunto de credenciais adequado ao risco avaliado,

desde códigos pessoais a dados biométricos. É também apresentada uma alternativa ao processo normal de

pagamento, que apesar de menos cómoda permite efectuar pagamentos quando não é possível estabelecer um

canal de comunicação sem fios, aumentando assim a tolerância a falhas. Esta solução não implica custos de operação

para o cliente na comunicação com o ponto de venda do comerciante, que é realizada através de tecnologias de

comunicação local sem fios, pode ser necessária a comunicação através da rede móvel com o emissor do agente de

pagamento para a actualização do agente de software ou de dados de segurança, mas essas transmissões são

ocasionais. O modelo de segurança recorre a certificados para autenticação dos intervenientes e a uma infra-

estrutura de chave pública para cifra e assinatura das mensagens. Os dados de segurança incluídos no agente de

software móvel, para desabilitar a cópia ou corrupção da aplicação mas também para a comparação com as

credenciais inseridas pelo cliente, devem igualmente ser encriptados e assinados de forma a garantir a sua

confidencialidade e integridade. A arquitectura de pagamento utiliza o standard de Web Services, que é amplamente

conhecido, aberto e interoperável, para a definição do serviço de pagamento. Existem extensões à especificação de

Web Services relativas à segurança que permitem trocar itens de segurança e definem o modo de cifra e assinatura

de mensagens, possibilitando assim a sua utilização em aplicações que necessitem de segurança como é o caso de

serviços de pagamento e controlo de acesso. O contracto de um Web Service define o modo de invocação dos

serviços, transmissão de informação e representação de dados, sendo normalmente utilizado o protocolo SOAP que

na prática não é mais que um protocolo de troca de mensagens XML (eXtensible Markup Language). O envio e

recepção de mensagens XML; ou seja, a transmissão de simples sequências de caracteres, é suportado pela maioria

dos protocolos de comunicação, sendo portanto uma solução abrangente que permite a adopção de diversas

tecnologias de comunicação sem fios. O protótipo construído inclui um agente de software móvel, implementado

sobre a forma de uma MIDlet, aplicação Java para dispositivos móveis, que implementa o protocolo de pagamento

comunicando sobre uma ligação Bluetooth com o ponto de venda do comerciante, simulado por uma aplicação

desenvolvida sobre a plataforma .NET e que por isso faz prova da heterogeneidade da solução. A comunicação entre

o comerciante e o seu banco para autorização do pagamento e transferência monetária utiliza o protocolo existente

para a autorização de pagamentos com base em cartões de crédito/débito.

A definição desta especificação aberta e genérica em conjunto com o forte interesse demonstrado pelos

intervenientes, proporcionam uma boa perspectiva em termos de adopção da solução, o que pode impulsionar a

12 Resumo

implementação de serviços móveis e dessa forma simplificar as rotinas diárias das pessoas. Soluções móveis de

pagamento reduzem a necessidade de transportar vários cartões de crédito/débito na nossa carteira. A avaliação

dinâmica de risco permite aumentar a segurança dos pagamentos, com a solicitação de mais credenciais ao cliente

para pagamentos com um maior risco associado, sendo um ponto importante quer para os clientes quer para as

instituições financeiras pois diminui o risco de fraude e aumenta a confiança no sistema. Esta solução de pagamento

electrónico pode também facilitar a consulta de pagamentos efectuados e saldos, mantendo um histórico dos

movimentos, o que não é possível nos cartões de crédito/débito sem uma visita a uma ATM (Automated Teller

Machine) ou utilização de homebanking.

Palavras-chave: pagamento sem fios, controlo de acessos, comércio electrónico, serviços móveis, dispositivos

nómadas, segurança, avaliação dinâmica de risco.

13 Introduction

Introduction

Since the beginning of mankind, economic trades were a fundamental activity for civilizations prosperity. Commerce

and business concepts have evolved over the years however the money notion remained essentially the same till the

20th

century. Currency is the unit of exchange most used in our common history, these metal or paper objects have

intrinsic value for humans and thus facilitate the transfer of goods and services [9]. In the last century the money

perception has changed, with the evolution of information technologies new means of payment had appeared and it

is nowadays possible to buy items with virtual money. This concept first emerged with bank money transfers and

credit cards, either way without the use of physical currency. The shift from physical to virtual payments has brought

benefits to clients and merchants. Virtual money usage simplify the payment transaction as it eliminates currency

searching and money change, the risk of theft is also decreased as the amount of currency carried by each person

reduces. Financial organizations view virtual money as a way of providing added convenience to their clients along

with an opportunity to reduce their operating costs [17].

Credit and debit cards, also known as ‘plastic money’, were the first successful alternative form of money, especially

designed to substitute currency in proximity payments. The issuer of credit cards grants a line of credit to the client

from where he can borrow money for payments or as a cash advance, debit cards on the other hand only allow the

cardholder to conduct payments if he has enough balance in his bank account. To perform payments it is typically

necessary to sign a receipt or introduce a Personal Identification Number (PIN) in the merchant’s Point of Sale (POS).

There are several brands of credit and debit cards, however they follow the same shape and size standard and

merchants typically support all the major brands. These cards can also be used in Automated Teller Machines (ATM)

to access to financial services in a public space without the need for a human clerk. Initial cards had a magnetic stripe

where bank account data was saved, however they are being replaced by more secure chip cards. Credit cards, ATMs

and telephone banking were the initial forms of electronic commerce (e-commerce), which consists in buying and

selling products or services over electronic systems [6]. However it was until the advent of Internet that e-commerce

would develop further and redefine the way in which business was conducted. The Internet and e-commerce

allowed the development of business-to-consumer (B2C) transactions and enabled trading between remote entities.

Security concerns emerged due to the unsecure nature of Internet, allied to the fact that nearly all the transactions

carried out through e-commerce are monetary and involve the flow of money in some form, usually using a credit

card. To address this issues and providing confidentiality, authenticity, and integrity of payment, e-commerce

protocols use a variety of cryptographic techniques, including encryption, digital signatures and certificates [6][17].

Recently, the emergence of wireless and mobile networks had made possible the extension of electronic commerce

to a new application and research area, mobile commerce (m-commerce), which is defined as the exchange or

buying and selling of commodities, services, or information through the use of mobile handheld devices. In just a few

years, mobile commerce has emerged from nowhere to become an important new trend in business transactions

[17]. The nomadic nature of mobile devices and their increasing capabilities enables proximity payments, which

involves the use of wireless technologies to pay for goods and services over short distances. Proximity transactions

develop the potential of m-commerce, for example, using a mobile device to pay at a POS, vending machine, ticket

machine, market, parking, and so forth. Using short-range wireless communication protocols, such as Bluetooth,

14 Introduction

Infrared or NFC (Near Field Communication), the mobile device can be transformed into a sophisticated terminal that

is able to process both micro and macro payments. In our modern society, communication and connectivity are

major requirements, as shown by the profusion of mobile phone terminals and wireless network access points,

known as hotspots, hence most people in an urban scenario carries at least one mobile phone. The ubiquity and

increasing computing capacity of mobile phones increases the interest in the development of wireless services and

foresights a bright future for m-commerce. The unification of various services in one device, providing new interfaces

for existing services, is a challenge that can simplify our daily routine. In an idyllic world we will stop using physical

money, credit cards, residence keys, or even any identification documents. The future of m-commerce, its prosperity

and popularity, will be brought to a higher level only if information can be securely and safely exchanged among end

systems, mobile users and content providers. Also, like in any type of commerce, clients have to trust merchants

and, likewise, merchants have to trust customers [17].

M-commerce has a widespread interest across stakeholders, from mobile phone manufacturers and mobile network

operators to financial institutions. While some players see mobile payments (m-payments) as a unique opportunity

to consolidate their role in the m-commerce value chain others are interested in adding value to their products or

services [17]. M-payment services are currently provided by mobile network operators, financial institutions and

independent vendors. Many differences exist between these enclosed proprietary payment solutions, most of them

answer to particular payment scenarios only supporting one service provider or a specific payment operation.

Although, there are a few organizations which were setup to develop a common mechanism for deploying mobile

payment services, yet no common standard has been adopted for mobile payment services [19]. The design of an

open, generic, interoperable and extensible architecture is therefore necessary for m-payment services widespread

adoption, supporting several service providers and payment types. The majority of existing wireless payment

solutions rely on mobile network communications, some see the mobile phone merely as a WAP (Wireless

Application Protocol) terminal that can browse the internet while others enable payment services through the

interchange of short text messages, using the SMS (Short Message Service) protocol. The utilization of mobile

network protocols implies the existence of communication fees in all payment transactions, operational costs make

such solutions inappropriate for micropayments and may have a limited acceptance by clients. These solutions focus

on remote payments scenarios, where client and merchant are not face-to-face but in reality most of our daily

payments are conducted near the merchant, thus they do not take advantage of proximity payments characteristics

and are not a real alternative to credit/debit card payments. Proximity electronic payments scenarios are illustrated

at Figure 1.

Figure 1 – Electronic payment scenario overview

15 Introduction

Mobile payment architectures involve several actors, besides clients and merchants, mobile network operators

(MNO) and financial institutes are usually present. Mobile network operators provide communication services over

which the payment transaction is usually performed, however instead of simply enabling the communication

between the parties they typically want to take place in the value chain. If the payment solution is provided by a

single financial institute then it must make available the necessary software agents both for the client and the

merchant, which typically communicate with the financial institute to approve each payment transaction. However if

several financial organizations endorse a payment system, more actors should be part of the process, the issuer, the

bank who delivers the mobile software agent to the client; and the acquirer, which provide clearing services on

behalf of the merchant; much like the credit card payment scenario. The existence of a clearing entity is common in

e-commerce because money transfers do not usually take place at purchase time, therefore a clearing entity must be

responsible for the transactions, including debiting the client and crediting the merchant.

Security is a main concern in several areas of human life, the fear induced due to terrorism or the apprehension

caused by the last financial crisis are examples where physical and economic security is necessary. In m-payment

solutions, which involve money transactions, security solutions must also mitigate risks and eliminate threats. In any

virtual money payment system, currency theft is not a risk, however these systems contain sensitive data like bank

account information that when compromised may enable access to client’s money. Besides keeping back account

details confidential, the solution must provide authentication and authorization measures to confirm client identity

and his/her permission to conduct payments. Authentication and authorization are the key features of access control

systems, where users need to present their credentials, in order to be authorized to access a particular resource.

Therefore inside a mobile payment service there is an access control service, Figure 2 depicts an access control

scenario.

Figure 2 – Access control scenario overview

The WPAC main goal is to define an open architecture for wireless payment and access control, using nomadic

devices and in particular mobile phones. WPAP solution should follow service oriented architecture (SOA),

preferentially through the usage of Web Services, which enables functionalities similar to credit cards. Security,

dependability [6] and dynamic risk assessment are key challenges and the biggest contribute of the WPAC project for

the development of m-commerce.

Roadmap

In the next chapter it will be discussed the state of art, including payment systems, current mobile technologies and

security solutions. Further ahead the WPAC architecture will be presented, with a focus on risk assessment and

security.

16 State of Art

State of Art

In this chapter it will be presented current mobile payment and access control solutions, mobile devices platform

characteristics, wireless communication protocols, security risks and solutions.

Mobile Payment and Access Control

Mobile payment (m-payment) is a new alternative payment method, focused on nomadic devices, which

complements traditional payment methods, such as cash, check or credit cards, and enables mobile phone users to

pay for wide range of services and digital or hard goods [6].

Payment Solutions

PayPal Mobile

PayPal is a popular online payment service. Via WAP-enabled phones the customer can use PayPal’s wireless

interface to accommodate mobile-payment. With PayPal Mobile, users can send money, purchase items or donate

to charities from their mobile devices. PayPal Mobile users make payments by sending a text message to PayPal.

PayPal calls the user back to confirm the mobile payment, and then sends the money to the recipient. In the case of

a Text to Buy purchase, after the merchant receives the payment, the item is shipped to the address already saved in

the user’s PayPal account. There are three convenient ways to use PayPal Mobile, through mobile phone web

browser, by text message or via a phone call to an automated voice system, as illustrated in the figure below.

Besides buying products, PayPal Mobile allows to check PayPal account balance and send money to anybody [4].

Figure 3 – Ways to use PayPal Mobile

P2P-Paid

The P2P-Paid architecture is a wireless payment system [1], which defines a lightweight peer-to-peer mobile

payment system that allows users to conduct wireless payments over mobile phones and perform secure

transactions with the P2P-Paid Server. The system is divided in two parts, the mobile client to mobile client

communication and the mobile client to server communication. The wireless communication between the mobile

devices is achieved through Bluetooth communication protocol. Both payer and merchant act as peers and join a

Bluetooth network advertising their role. The merchant publishes his information, a protocol specific identifier

(P2PID), onto the network to become visible to payers. Then the payer searches for payees in the network using

Bluetooth’s Service Discovery Protocol (SDP) and selects one to make a payment. At this time the user inputs the

amount and a simple description for the payment. His mobile phone encrypts the data and send to the P2P-Paid

Server. The server decrypts the payment data, validates client and merchant accounts and checks for available

17 State of Art

balance in client’s account. In case of success the transaction is performed and the parties are notified through a

receipt is sent to payer and payee mobile devices. This communication is performed over HTTP/HTTPS protocols with

a security header attached to messages. This usage scenario is depicted in Figure 4.

The P2P-Paid business process relies on an online server to commit the money transaction synchronously. The

mobile phone Bluetooth communication between client and merchant only provides the identification of the

merchant. The communication with the server via HTTPS has an associated fee that is debited from client mobile

operator account.

Figure 4 – P2P-Paid usage scenario

SEMOPS

SEMOPS (Secure Mobile Payment System) is a complex, universal, user friendly payment system. The possible

transactions include POS payments, in band purchases – Internet and WAP, P2P transfers, purchases made at

vending machines and also bill payments. The payments are not limited by values either, as both micro and macro

transactions can be performed. For customers and merchants, the payment service is provided by their own banks or

mobile operators. As no intermediaries are involved in this relationship the whole payment transaction is based on

trust between known partners. In SEMOPS customers do not provide any sensitive data to the merchant during the

payment process therefore they can practically remain anonymous during the payment process. Having received the

necessary transaction details, the customer prepares and signs a payment request and forwards it to its own

payment processor. If the necessary funds are available the merchant receives a payment notification, a kind of

guarantee from its own payment processor [74].

Reverse-Charge/Billed SMS

Reverse-billed premium rate SMS services deliver content to mobile phones for a fee. Clients typically subscribe a

service and are charged a premium for the messages they receive. The payment model enables clients to use SMS

text messaging to anonymously pay for access to digital entertainment and content. Reverse SMS billing means that

the owner of the recipient phone rather than the message sender is charged for the cost of the SMS message

received. There are various vendors offering reverse-charge SMS services, however this payment scenario is not

suited for the purchase of hard goods but rather digital goods received on the mobile device, such as ringtones or

informative messages [19].

18 State of Art

Vodafone m-pay

In the Vodafone m-pay solution, users are billed for the purchase items directly on their mobile phone invoice, next

to phone services. Hence, on opposite to reverse-billed SMS, there is no need to send a SMS each time a client

makes a payment or receives a solicited content. Instead, clients are billed when they enter their username and

password details on the web or WAP site where they are buying content from [19].

Secure Electronic Transaction

Secure Electronic Transaction (SET) is a standard protocol for securing credit card transactions over insecure

networks, specifically, the Internet [3]. SET is not itself a payment system, but rather a set of security protocols and

formats that enables users to employ the existing credit card payment infrastructure on an open network in a secure

fashion. Although SET is not designed to support payments on mobile devices, it provides a good clarification of

actors, roles and protocols in an electronic distributed payment system. The SET system includes the following

participants: cardholder, the client performing a purchase; merchant, the entity providing products or services;

issuer, the company that provides the cardholder with the credit card; the credit card’s brand; acquirer, an

organization that provides card authorization and payment capture services for merchants; payment gateway, which

provides, in behalf of the acquirer, an interface between SET and existing bankcard association; and certification

authority, which provides public key certification [3].

Figure 5 – SET actors

The SET specification include five protocols that can be divided into two phases: the registration phase, where the

participants obtain electronic credentials that replace traditional credit cards numbers and protect their privacy; and

the purchase phase which is at the center of the SET protocol. The registration phase includes the cardholder,

merchant and payment gateway certification processes, all of which include communication with the corresponding

certification authority. The cardholder provides additional details in his registration process, so that a credit card

number is associated with him. The SET payment transaction includes a Purchase process between the cardholder

19 State of Art

and the merchant; a Payment Authorization process, which allows a Merchant to verify and authorize the

Cardholder's details with a Payment Gateway; and Payment Capture process that is used by Merchants for the

actual fund transfer [3][37].

Access Control Solutions

Most payment solutions are traceable, that it, there is complete information about every step in a process chain.

This means that payers identity is know and the payment is not anonymous like in traditional cash payments. The

introduction of client’s credentials, to validate his/her identity, also can be used for access control. Furthermore the

purchase of digital tickets binds m-payments and access control in the same usage scenario.

M-Ticket

M-Ticket (mobile ticket) is a proposal of a virtual ticket that substitute the conventional paper version. Upon ticket

purchase a text message is sent to the client’s mobile phone. This message includes a numeric code relative to the

ticket and optionally may also contain an electronic code. The electronic code represents the same information that

the numeric one. However it simplifies the ticket presentation process, as the client only needs to approach the

mobile phone screen, displaying the electronic code, to an optic reader.

A ticket must be unique and not transmissible. Personal identification credentials share the same premises, but with

an extra focus in its security. The M-Ticket solution provides a good base for studying an alternative for personal

identification and access control. This is important to provide countermeasures when the main process is not

available, and thus increase dependability.

Figure 6 – M-Ticket detail

Summary

Nowadays there are two primary models for mobile payments, premium SMS based transactional payments, and

Mobile Web payments through WAP or Mobile Network communication. Reverse-billed premium rate SMS are still

common as a payment option for the purchase of digital content for mobile phones, however this model never

achieved success in others payment scenarios, mainly due to poor reliability. On the other hand, m-payment

solutions, based on Mobile Network communications to access online payment servers, provide a richer usage

experience but are tightly connected with remote online payment scenarios and imply communication fees, not

taking advantage of mobile phones local communication capabilities.

20 State of Art

Mobile Devices

There are several types of mobile devices, in fact the definition is too broad and includes any piece of equipment

that is easily carried around, ranging from pagers to laptops. M-payment solutions require mobile computing

capabilities and thus are limited to certain types of devices. Devices’ availability is also critical to the success of such

applications.

Types and availability

Pagers, calculators, digital cameras and music players are examples of mobile devices not suitable to payment

solutions, even though all of them have intrinsic processing capabilities they are not easily programmable nor have a

generic interface. Devices that support the installation of new applications, like laptops and mobile phones, but even

game consoles, are more suited as platform for the development of m-services. Laptops are probably the most

powerful mobile devices but they are not as available as others devices and are somewhat difficult to carry around.

In the last years, a smaller version of portable computers, called netbooks, have been emerging, although more easy

to transport they are even less available then their laptops counterpart. Portable computers are not the ideal choice

because typically, in order to use them, it is necessary some kind of installation, like sitting down, open the lid and

power on the device. On the other end, mobile phones are highly available in urban scenarios and are becoming

smaller and smaller, thus increasing its mobility. PDAs (Personal Digital Assistants) and smartphones are typically

bigger then mobile phones, but also have more processing power, however they are slightly less available due to the

higher purchase cost. Portable game consoles can also receive customized applications and typically have intrinsic

communication capabilities, but they have a lower mobility and availability thus removing them from the first choice.

Figure 7 estimates the positioning of several mobile devices accordingly to availability and mobility.

Figure 7 – Devices mobility and availability

Mobile phones

In Portugal mobile phones reached a penetration rate of 137% in 2008, meaning that there are 137 active mobile

phone numbers for each 100 habitant [7]. In 2007, European Union reached a penetration rate of 112%, while

United States and Japan, still below 100%, attained rates of 87% and 84% respectively [55]. There are an estimate 1.5

billion mobile phones in the world today, this is more than three times the number of personal computers (PCs), and

today’s most sophisticated phones have the processing power of a mid-1990s PC. The high availability, mobility and

increasing computing capabilities make the mobile phone the key device for the development of mobile solutions.

Also, the rapid and widespread adoption of camera phones suggests that stakeholders and consumers are willing to

Mobility

Availability

PDA

Laptop

Mobile phone

Game console

Netbook

21 State of Art

invest in more expensive devices and mobile services

benefits [53]. Observers speculate that in a near future a new class of ‘always

products categorized as Ultra-Mobile Devices (UMDs)

an alternative to a PC [59].

Figure

Almost all new mobile phones have a digital camera embedded, some devices have a video

others are tailored for music reproduction and some smartphones are shipped with touch screens. The diversity of

models in the modern mobile phone market caters for a wide variety of customer

are tiny and discreet, some are chosen

match the owner’s outfit, some just offer basic functionalit

leisure services to their users [53]. Thus mobile phone users can be grouped in various profiles according

tastes, but more significantly by their typical mobile phone’s service usage. Users that only make use of typical voice

services are less likely to endorse m-payment solutions than young users eager to try the every new feature.

Nokia is the predominant mobile phone manufacturer in Portugal but also worldwide, reaching a market share over

50% in the global market. Nokia also has a leading role in mobile applications development, providing tools for

developers and supporting them in online foru

Figure 9 – Mobile phones manufacturers’ Portuguese market share in February 2009

98%

0

5

10

15

20

2004

Su

bsc

rib

ers

(M

illi

on

s)

9,84

and mobile services if they are attractive enough and offer significant or perceived

Observers speculate that in a near future a new class of ‘always-on’ devices,

Mobile Devices (UMDs), will emerge and mobile phones will become more and more

Figure 8 – Mobile phone penetration rate in Portugal

Almost all new mobile phones have a digital camera embedded, some devices have a video

others are tailored for music reproduction and some smartphones are shipped with touch screens. The diversity of

ne market caters for a wide variety of customer tastes and lifestyles. Some phones

are tiny and discreet, some are chosen for their appearance, like a fashion accessory with alternative covers

just offer basic functionality while some others provide a wide range of

Thus mobile phone users can be grouped in various profiles according

tastes, but more significantly by their typical mobile phone’s service usage. Users that only make use of typical voice

payment solutions than young users eager to try the every new feature.

predominant mobile phone manufacturer in Portugal but also worldwide, reaching a market share over

50% in the global market. Nokia also has a leading role in mobile applications development, providing tools for

developers and supporting them in online forums.

Mobile phones manufacturers’ Portuguese market share in February 2009

106% 113% 122% 137%

0%

50%

100%

150%

2005 2006 2007 2008

PT Subscribers PT Penetration Rate

44,05

15,73

25,74

Nokia

Sony-Ericsson

Samsung

Sharp

Motorola

Sagem

if they are attractive enough and offer significant or perceived

on’ devices, Internet-connected

, will emerge and mobile phones will become more and more

Almost all new mobile phones have a digital camera embedded, some devices have a video-game oriented interface,

others are tailored for music reproduction and some smartphones are shipped with touch screens. The diversity of

tastes and lifestyles. Some phones

with alternative covers to

y while some others provide a wide range of business and

Thus mobile phone users can be grouped in various profiles accordingly with their

tastes, but more significantly by their typical mobile phone’s service usage. Users that only make use of typical voice

payment solutions than young users eager to try the every new feature.

predominant mobile phone manufacturer in Portugal but also worldwide, reaching a market share over

50% in the global market. Nokia also has a leading role in mobile applications development, providing tools for

Mobile phones manufacturers’ Portuguese market share in February 2009

0%

50%

100%

150%

Pe

ne

tra

tio

n R

ate

Ericsson

Samsung

Motorola

22 State of Art

Operating Systems

Modern mobile phones are systems that have mobile operating system like Symbian, iPhone OS, Windows Mobile or

the recent Android. In these devices, users can have different applications like operating-system dependant native

programs, or virtual-machine dependant programs [56]. Java Micro Edition platform is supported is most devices,

some of them, most likely smartphones with Windows Mobile operating system, can also support applications

written for .NET Compact Framework.

Symbian

Symbian OS is an operating system designed for mobile devices, with associated libraries, user interface, frameworks

and reference implementations of common tools, developed by Symbian Ltd., which runs exclusively on ARM

processors. Symbian OS is superseded by Symbian, following the official launch of the Symbian Foundation in April

2009. Symbian is the leading OS in the smart mobile device market, used mostly by Nokia mobile phones. By

November 2008 statistics showed that Symbian OS had almost 50% of market share [6]. The native language of

Symbian is C++, although it is not a standard implementation. There were multiple platforms based upon Symbian OS

that provided SDKs for application developers wishing to target Symbian OS devices, including .NET and Java ME

platforms.

Windows Mobile

Windows Mobile is a compact operating system combined with a suite of basic applications for mobile devices based

on the Microsoft Win32 API. Devices that run Windows Mobile include Pocket PCs, Smartphones, Portable Media

Centers, and on-board computers for certain automobiles. Third-party software development is available both in

native code, with Visual C++, or Managed code that works with the .NET Compact Framework [6]. Like in the desktop

Windows editions, the Java Virtual Machine can be installed in Windows Mobile, yet this may not be a good solution

as the deployment of a Java MIDlet may also imply that clients need to install the JVM.

iPhone OS

The iPhone OS is the operating system developed by Apple for the iPhone. iPhone OS is derived from Mac OS X but is

targeted for ARM-based processors. iPhone OS' user interface is based on the concept of direct manipulation, using

multi-touch gestures, such as swiping, tapping and pinching. Interface control elements consist of sliders, switches,

and buttons. Additionally, using internal accelerometers, rotating the device on its axis alters the screen orientation

in some applications. The development of applications to iPhone is available through the iPhone SDK, using the

provided libraries and programming in the Objective-C language. Apple has not announced any plans to enable Java

to run on the iPhone, although Sun Microsystems announced plans to release a Java Virtual Machine for iPhone OS,

the SDK’s terms of agreement could hinder the development of the JVM without Apple's cooperation [6].

Android

Android is a mobile operating system running on the Linux kernel. It was initially developed by Google and later the

Open Handset Alliance. It allows developers to write managed code in the Java language, controlling the device via

Google-developed Java libraries. Android is a free and open source software that intents to become a de facto open

standard in mobile operating systems. According to Google, by the end of 2009 there will be at least 18 phone

23 State of Art

models shipped with Android worldwide, this includes manufacturers such as HTC, LG, Motorola, Samsung and Sony

Ericsson, that is, most mobile phones manufactures except Nokia [6].

Java is currently the predominant virtual machine supported by mobile phones, thus developers should aim for the

Java Virtual Machine in order to cover a larger audience. Initially Java MIDlets were very limited, and access to device

peripherals was not available, however the number of supported Java APIs has been increasing and thus mobile

applications can be more powerful.

Health issues

Over the last years some rumors about health issues associated with long term mobile phone usage have been

appearing. Even so, accordingly with the National Radiation Protection Board’s (NRPB) independent Advisory Group

on Non-Ionising Radiation (AGNIR), there is no biological evidence for mutation or tumor causation by Radio

Frequency (RF) exposure, and epidemiological studies overall do not support causal associations between exposures

to RF and the risk of cancer, in particular from mobile phone use. AGNIR found a number of studies that suggested

possible effects on brain function at RF exposure levels comparable with those from mobile phone handset use.

AGNIR regarded the overall evidence as inconclusive but did not state that mobile phones have been proven to be

entirely risk free. The weight of evidence now available does not suggest that there are adverse health effects from

exposures to RF fields below guideline levels, but the published research on RF exposures and health has limitations,

and mobile phones have only been in widespread use for a relatively short time [53].

Wireless Communication

Wireless communication technologies and protocols have a significant role in mobile payment systems. However

they are really only a mean to an end, thus communication technologies, usually present at mobile devices, will be

analyzed by a user view point, not focused on inner architecture but instead understanding their functionalities and

possibilities, as the WPAC solution builds on top of them.

Mobile Network Telecommunication

Originally designed for voice-only communication, mobile systems have evolved from analog to digital and from

circuit-switched to packet-switched networks. Currently we are in the third generation of wireless cellular networks.

1th Generation system such as AMPS (Advanced Mobile Phone System) and TACS (Total Access Control System) are

obsolete and thus will not play a significant role in mobile commerce systems. GSM (Global System for Mobile

communications) and its enhancement GPRS (General Packet Radio Service) protocol have mainly been developed

and deployed in Europe. GPRS can support data rates of only about 100 kbps, but its upgraded version, the EDGE

(Enhanced Data for Global Evolution) protocol, is capable of supporting 384 kbps. Currently, most of the cellular

wireless networks in the world follow 2G and 2.5G standards. However, there is no doubt that in the near future, 3G

systems with a quality-of-service capability will dominate wireless service, the two main standards for 3G are

Wideband CDMA (WCDMA) and CDMA2000, both use a 5 MHz bandwidth. Technical differences between them

include a different chip rate, frame time, spectrum used, and time synchronization mechanism. The WCDMA system

24 State of Art

can inter-network with GSM networks and has been strongly supported by European Union, which call it UMTS

(Universal Mobile Telecommunication System) [17].

WAP

The WAP (Wireless Application Protocol) protocol is designed to work with all wireless networks. The most

important technology is probably the WAP Gateway, which translates requests from WAP protocol stack to the

WWW stack, so they can be submitted to Web servers. For example, requests from mobile stations are sent as a URL

through the network to the WAP Gateway, responses are sent from the Web server to the WAP Gateway in HTML

and are then translated to WML (Wireless Markup Language) and sent to the mobile stations [17].

Short-Range Wireless Communication Technologies

Besides mobile network communications, usually mobile phones also support short-range wireless communication

protocols, like IrDA, Bluetooth or NFC.

IrDA

IrDA (Infrared Data Association) was launched in 1993 as a cable replacement technology using infrared light pulses.

In 1997, IrDA introduced the first version of the OBEX (OBject EXchange) protocol, allowing IrDA-enabled devices to